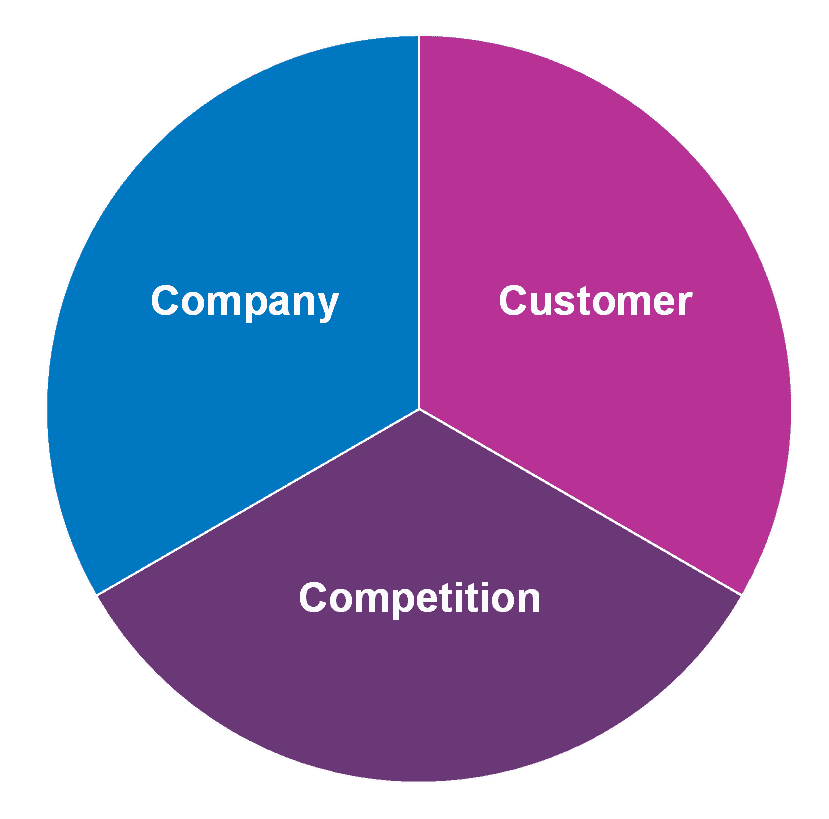

What is 3C in Marketing?

The 3C in marketing refers to the three key elements that businesses must consider when developing a marketing plan. The 3Cs are: company, customer, and competition. 3C is a very powerful marketing framework, along with the 4P in marketing.

The concept of the 3Cs was first introduced in the 1960s by Harvard Business School professor, Kenichi Ohmae. The idea was to provide a simple framework for businesses to analyze their marketing strategies and make informed decisions.

The first “C” in the 3Cs stands for “company”. This refers to the internal factors that affect a company’s marketing strategy, such as its strengths, weaknesses, resources, and capabilities. By examining its internal environment, a company can identify its unique value proposition and create a marketing plan that aligns with its overall goals and objectives.

The second “C” stands for “customer”. This refers to the external factors that affect a company’s marketing strategy, such as customer needs, wants, and preferences. By understanding its target market and their needs, a company can create a product or service that meets their needs and desires.

The third “C” stands for “competition”. This refers to the external factors that affect a company’s marketing strategy, such as competitors’ strengths and weaknesses, market share, and pricing strategies. By analyzing the competitive landscape, a company can identify opportunities and threats and develop a marketing plan that differentiates itself from its competitors.

The 3Cs are used by businesses to develop a marketing strategy that is tailored to its unique internal and external environment. In the rest of this article, we’ll learn about the 3Cs of marketing in greater detail.

Company

Company

In the context of the 3C marketing model, “company” refers to the internal factors that affect a business’s ability to compete.

This includes the company’s mission, culture, strengths, and weaknesses. A thorough analysis of these internal factors can help a company identify its competitive advantages and limitations.

To conduct a company analysis, start by examining the company’s mission statement and values. This will help you understand the company’s goals and the principles it operates under.

Next, evaluate the company’s strengths and weaknesses. Strengths may include a talented workforce, a strong brand reputation, or proprietary technology. Weaknesses may include a lack of resources, poor management, or outdated technology.

It’s important to be honest in your evaluation and to focus on areas where the company can improve. By identifying weaknesses, a company can develop strategies to address them and become more competitive.

Additionally, consider the company’s culture and how it affects its ability to compete. Does the company prioritize innovation and risk-taking? Or does it prefer to stick to tried-and-true methods? Understanding the company’s culture can help identify areas where changes may need to be made.

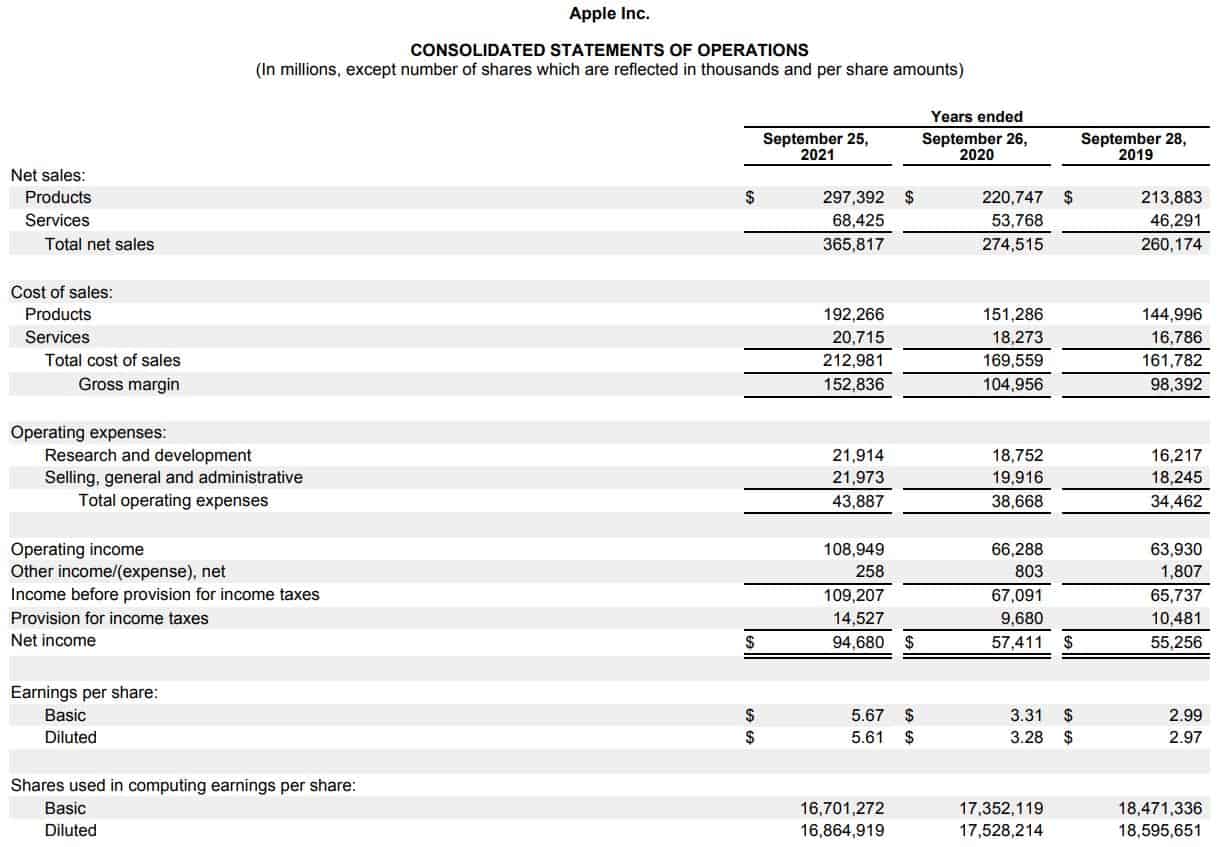

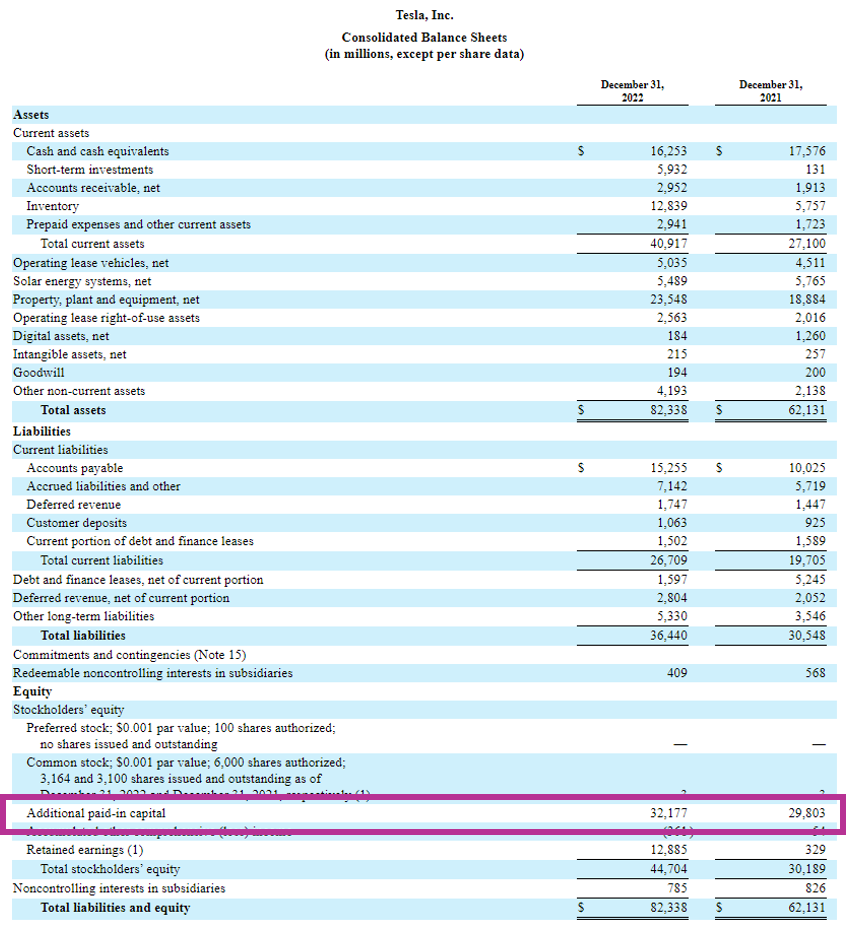

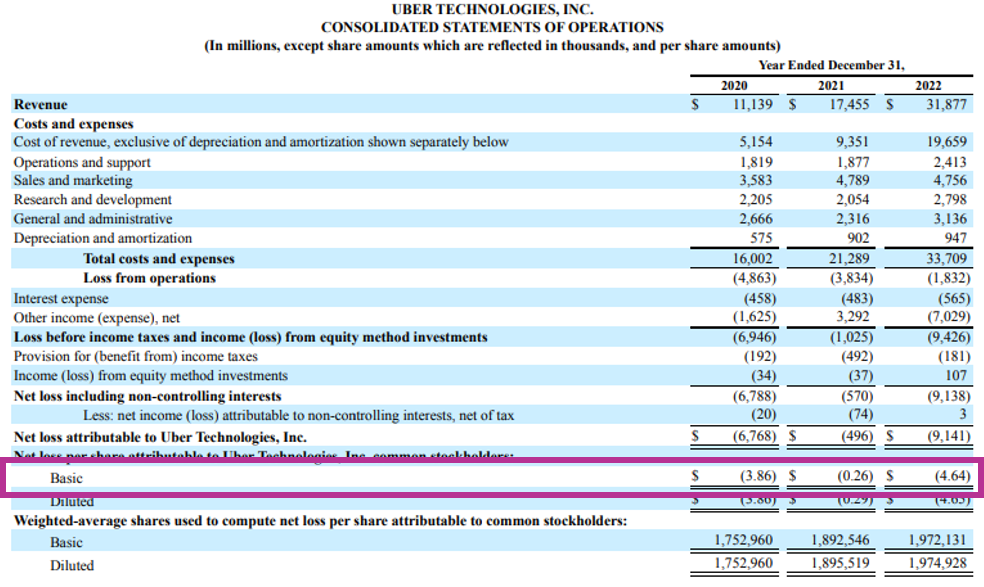

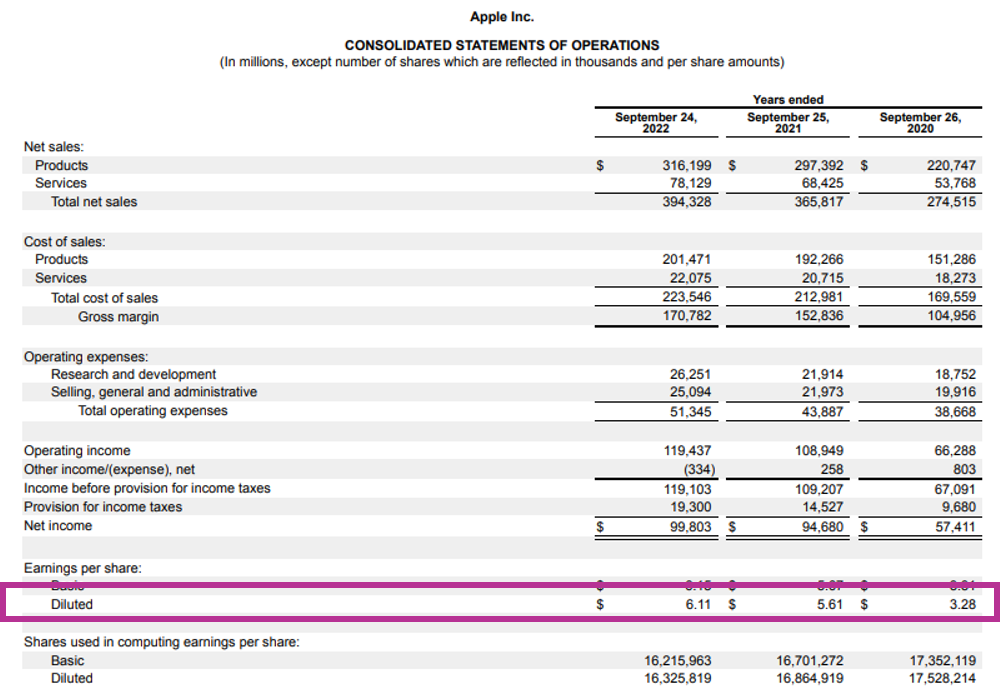

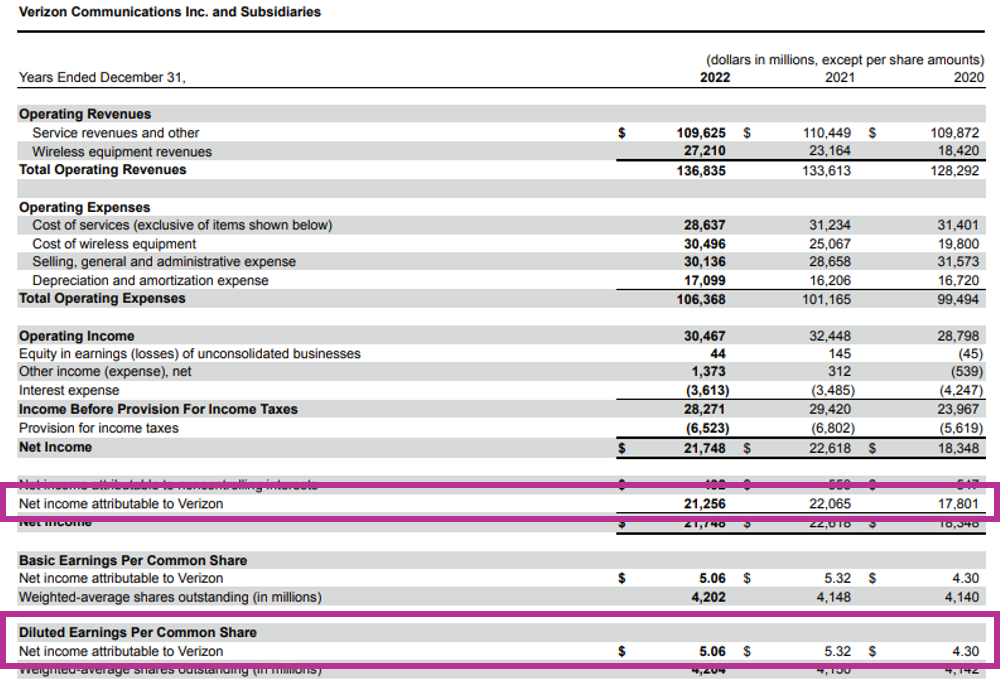

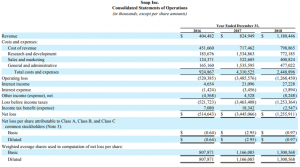

Finally, look at the company’s financial performance and market position. Is the company profitable and financially stable? How does it compare to its competitors in terms of market share?

Overall, analyzing the company in the 3C model provides insight into its internal strengths and weaknesses, as well as its overall competitive position. This information can then be used to develop effective marketing strategies that capitalize on the company’s strengths and mitigate its weaknesses.

Customer

In the context of the 3C marketing model, “customer” refers to the target market that a company is trying to serve. The customer is the ultimate focus of any marketing strategy, as the success of the company is dependent on meeting the needs and wants of its customers.

Understanding the customer is a critical aspect of the 3C model, as it provides insight into what products or services will be most attractive to them. Companies need to gather data and analyze their customers’ behavior, preferences, and demographics to develop effective marketing strategies.

One of the main benefits of the 3C model’s customer focus is the ability to create customer value. By understanding what customers want and need, companies can tailor their products and services to meet those needs, thus providing value to the customer.

Additionally, by focusing on the customer, companies can differentiate themselves from competitors by providing unique offerings that meet the needs of their target market. This differentiation can lead to increased customer loyalty and brand equity.

However, there are also challenges associated with the customer component of the 3C model. One such challenge is that customers’ preferences and needs are constantly changing, and companies must adapt their strategies accordingly. This requires ongoing research and data analysis to stay ahead of the curve.

Another challenge is that the customer component of the 3C model is not the only factor that influences purchasing decisions. Other factors, such as price, competition, and technological advancements, must also be taken into account.

Despite these challenges, the customer component of the 3C model remains an essential aspect of successful marketing strategies. Companies that prioritize understanding and meeting the needs of their customers are more likely to build long-term relationships and achieve sustainable growth.

Competition

In the 3C model, competition refers to the external factors that can impact a company’s success. Understanding the competition is critical to a company’s success, as it can help identify potential threats and opportunities.

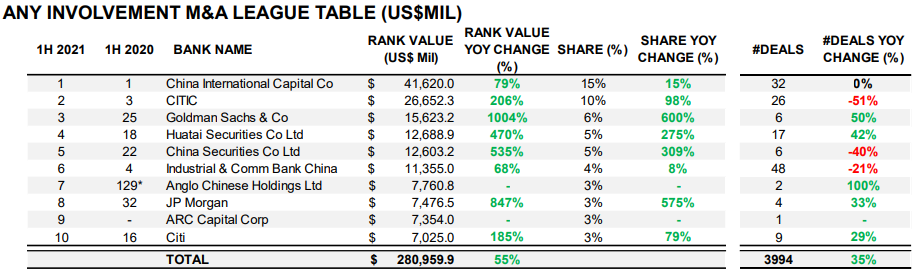

To analyze competition, companies must first identify who their direct competitors are. This involves looking at other companies that offer similar products or services to the same target market. Once the competitors are identified, the company can analyze their strengths and weaknesses.

One way to analyze competition is through a SWOT analysis. This can help identify the strengths and weaknesses of the competitors, as well as the opportunities and threats that they present.

Another way to analyze competition is by looking at the market share of each competitor. This can help identify which competitors are dominant in the market and which are struggling.

Companies can also analyze the pricing strategies of their competitors. This can help identify potential pricing advantages and disadvantages.

Additionally, companies can analyze the marketing and advertising strategies of their competitors. This can help identify potential opportunities and threats in terms of reaching the target market.

3C Marketing Model Example

Nike is a global company that designs, develops, and sells athletic footwear, apparel, and accessories. The company operates in more than 190 countries and employs over 75,000 people worldwide. Let’s take a closer look at the company aspect of 3C analysis for Nike.

Nike 3C – Company

One of Nike’s strengths is its strong brand image and reputation. Nike has a well-established brand identity that is recognized globally. Its “swoosh” logo is one of the most recognizable logos in the world, and the company’s tagline, “Just Do It,” is widely recognized and associated with the brand.

Another strength is Nike’s ability to innovate and produce high-quality products. The company invests heavily in research and development to create new and improved products, such as Nike Flyknit and Nike Air. This has helped the company maintain a competitive edge and remain a leader in the athletic apparel and footwear industry.

However, Nike faces some weaknesses in terms of its supply chain management. The company has faced criticism for its labor practices in its overseas factories, including accusations of poor working conditions and low wages. Nike has taken steps to address these issues, but they remain a concern for the company.

Nike also faces challenges in terms of sustainability. As a company that relies heavily on the use of natural resources, such as water and cotton, Nike has a responsibility to reduce its environmental impact. While Nike has made progress in this area, there is still room for improvement.

Overall, Nike has a strong brand identity and innovative product line, but needs to address issues in its supply chain management and sustainability practices to maintain its competitive edge and meet the demands of consumers who are increasingly conscious of ethical and environmental concerns.

Nike 3C – Customer

Nike has a large and diverse customer base, ranging from athletes to fashion-conscious consumers. Their focus on creating high-performance products for athletes has allowed them to establish a strong brand identity and reputation for quality. This has led to a loyal customer base that values the Nike brand and the products they produce.

Nike uses a range of marketing techniques to appeal to their customers, such as advertising campaigns that showcase their products in action and collaborations with high-profile athletes and celebrities. They also invest heavily in research and development to create innovative products that meet the evolving needs and preferences of their customers.

However, Nike also faces challenges in the customer element of the 3C model. The company has been criticized for their labor practices in the past, which can negatively impact their reputation and relationships with customers who value ethical production. Additionally, the company faces increasing competition from both established brands and new entrants in the athletic and athleisure market.

To address these challenges, Nike has taken steps to improve their labor practices and communicate their commitment to ethical production to customers. They have also focused on expanding their product offerings beyond traditional athletic wear to appeal to a wider range of consumers. This includes collaborations with fashion designers and expanding their lifestyle product lines.

Overall, Nike’s focus on creating high-quality, innovative products and their strong brand identity have allowed them to establish a loyal customer base. However, the company must also address challenges such as ethical production and increasing competition to maintain their customer relationships and continue to grow in the market.

Nike 3C – Competition

Nike operates in a highly competitive market. The athletic apparel and footwear industry is dominated by major brands.

Nike faces strong competition from major brands such as Adidas, Under Armour, Puma, and Reebok. Adidas has emerged as a major competitor in recent years, with its focus on retro-style products and collaborations with celebrities and influencers. Under Armour, on the other hand, has positioned itself as a brand that caters to athletes and fitness enthusiasts, while Puma has targeted the lifestyle market. Reebok has focused on sustainability and social responsibility to differentiate itself from its competitors.

Nike has strategically collaborated with other companies in the industry, such as Apple and Amazon, to expand its reach and stay ahead of the competition. For example, Nike’s collaboration with Apple has led to the development of the Nike+ running app, which allows users to track their runs and compete with other runners. Similarly, Nike’s partnership with Amazon has helped the company reach a wider customer base through the online retailer’s vast distribution network.

Nike’s strength lies in its ability to innovate and create products that are technologically advanced and stylish. The company invests heavily in research and development to create new products and improve existing ones, which gives it an edge over its competitors. Nike has also successfully leveraged its brand image and marketing campaigns to create a strong emotional connection with consumers, which has helped it maintain its position as a leading brand in the industry.

Overall, Nike faces intense competition in the athletic apparel and footwear industry, but its strong brand image, innovative products, and strategic partnerships have helped it stay ahead of the curve. The company continues to invest in research and development to stay ahead of its competitors and maintain its position as a leader in the industry.

Learn More

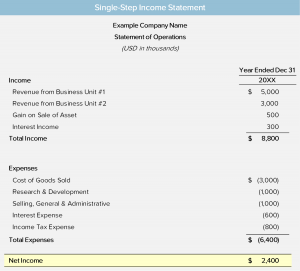

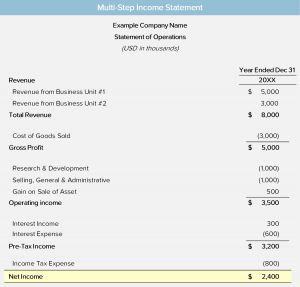

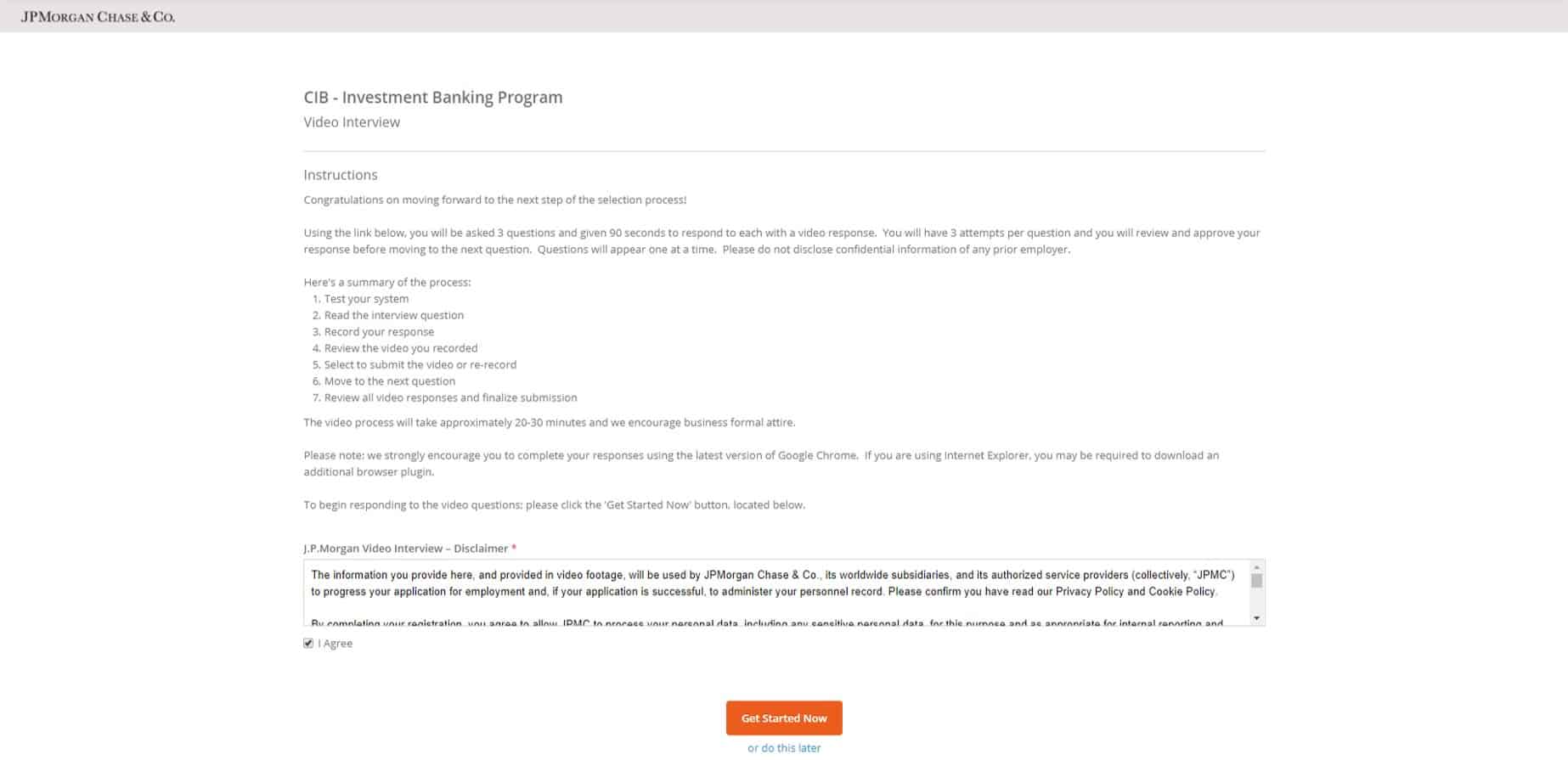

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Trust us, our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.

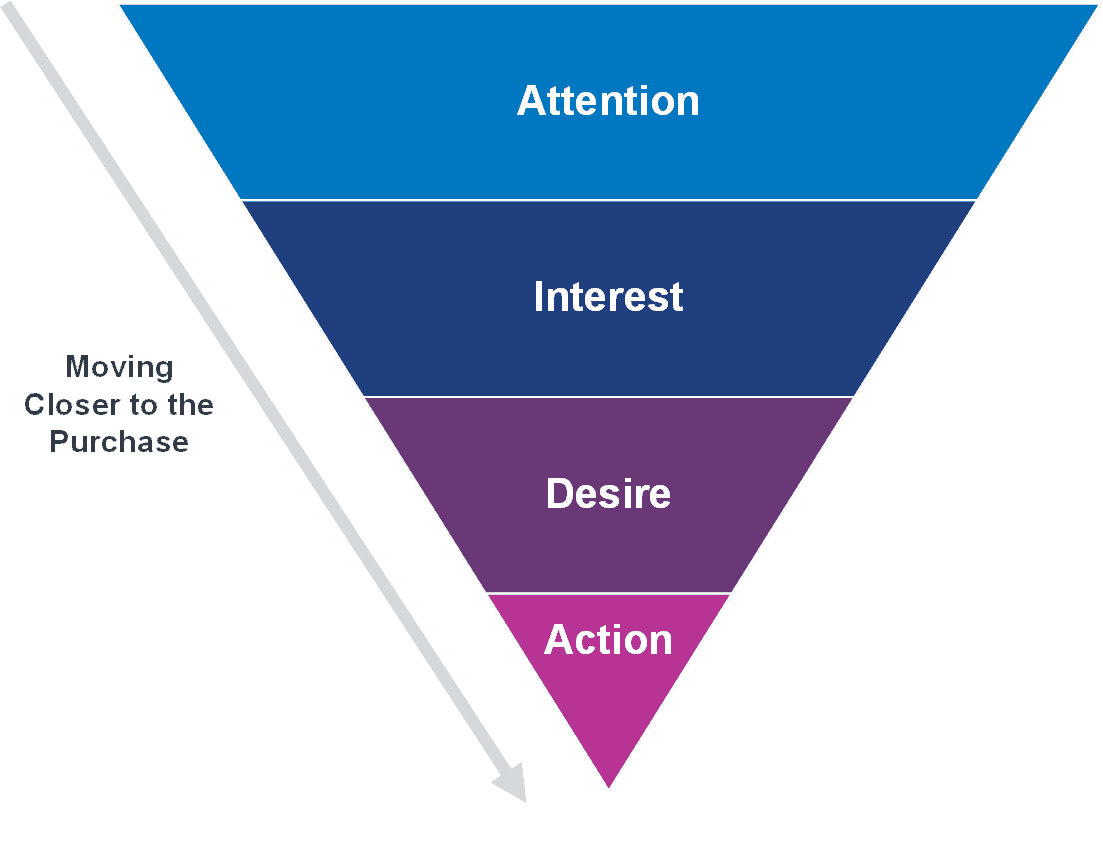

First Step: Attention

First Step: Attention

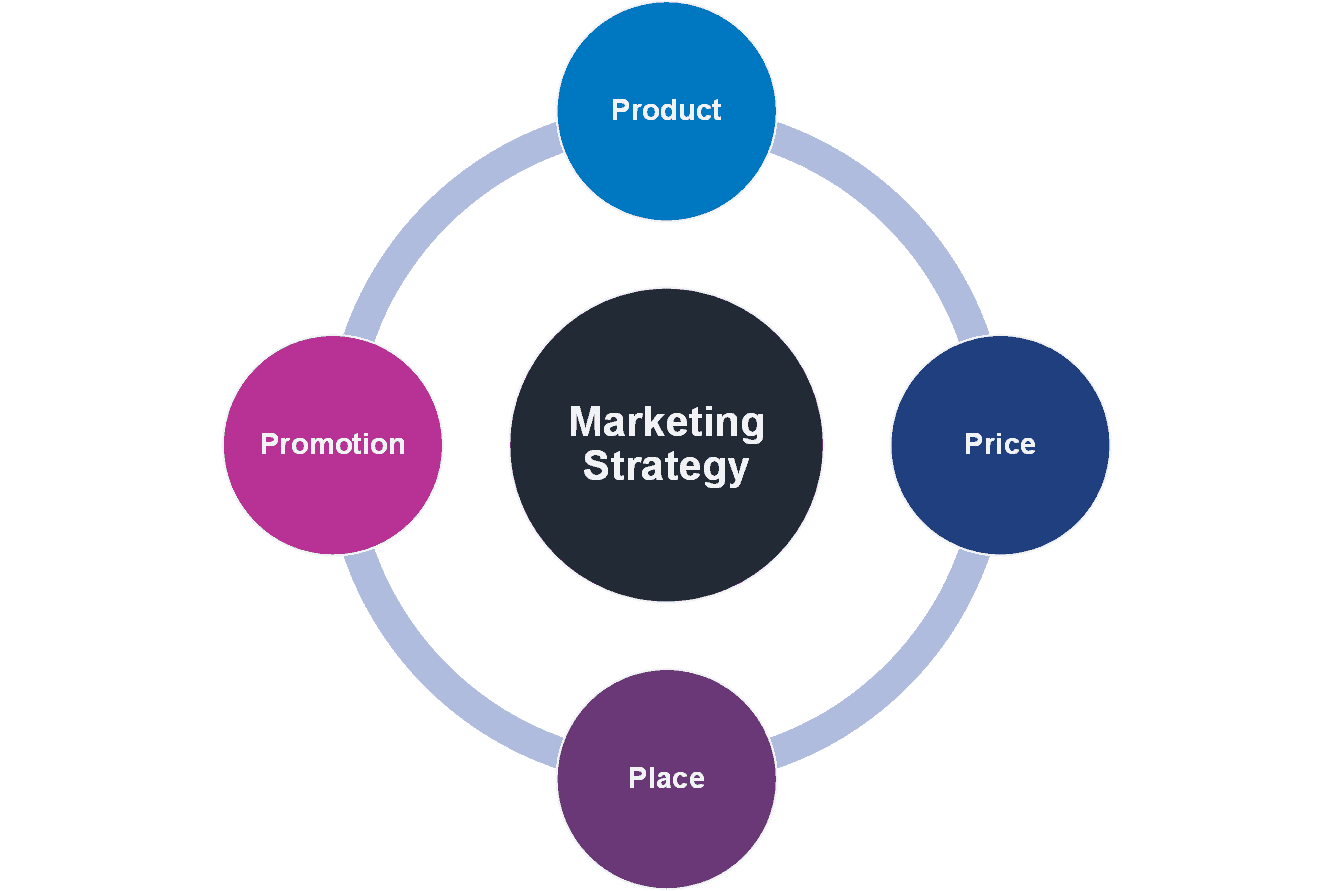

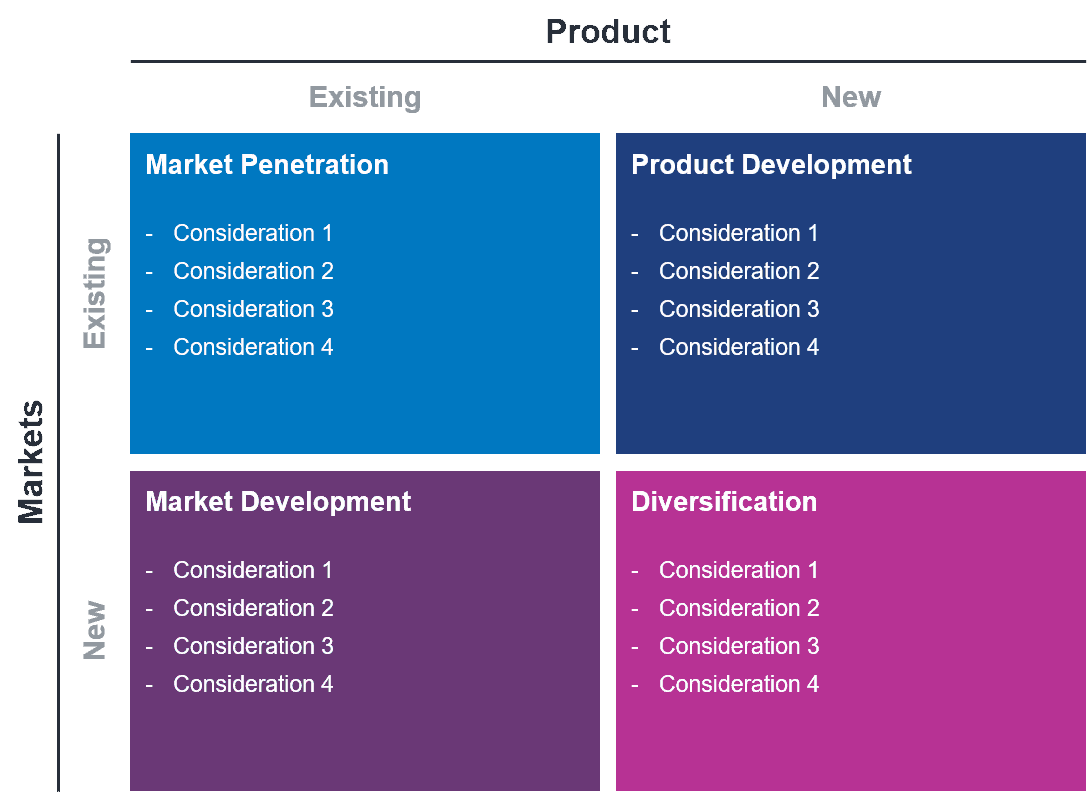

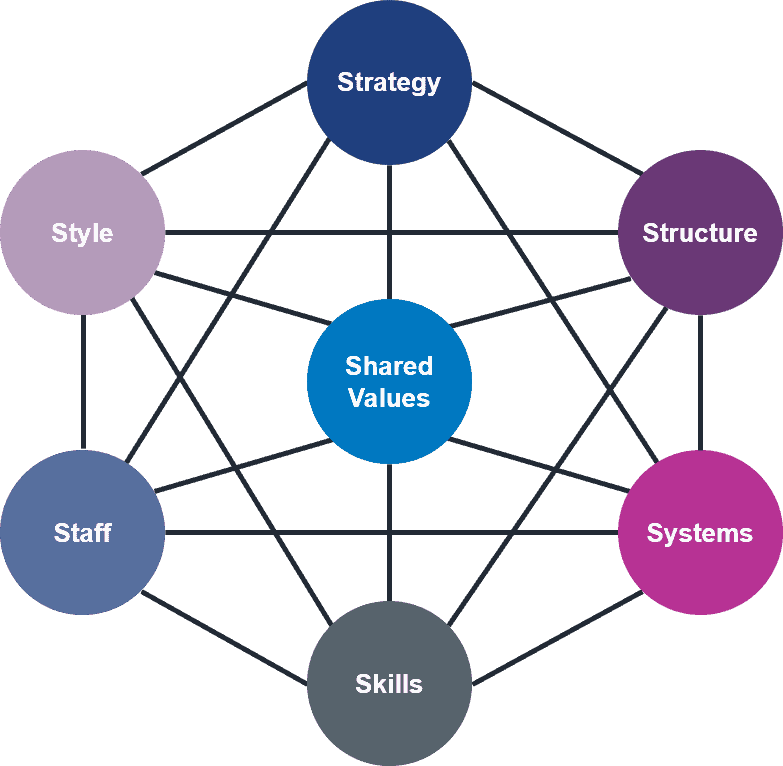

Strategy

Strategy