What is Diluted EPS?

Diluted EPS, or Diluted Earnings Per Share, is one of the financial metrics that measure a company’s profitability. Specifically, Diluted EPS measures the amount of Net Income a company earns for each of its common stock outstanding and common stock that will get created in the future. We go over the topic of Diluted EPS in greater detail in our curriculum: Course 6, Lesson 11.

To calculate Diluted EPS, we divide Net Income by the Diluted Weighted Average Shares Outstanding (Diluted WASO). For example, suppose a company has $3 million Net Income and 2 million Diluted WASO. In this case, its Diluted EPS is $1.50.

In general, Earnings per Share (EPS) is an extremely important number. It comes in two forms: Basic EPS and Diluted EPS. Basic EPS is almost never used while Diluted EPS is almost always used in financial analysis. This makes Diluted EPS an absolutely essential number in finance.

During our time working in investment banking at Goldman Sachs and in private equity, we used Diluted EPS whenever we had to reference per share earnings. The implication is that as you read about “EPS” online, or in books, or in the news, you should know that chances are they’re referring to Diluted EPS when they say “EPS”. They are not referring to Basic EPS. We go over how to use EPS in financial analysis in our curriculum. Specifically, Course 3 covers calculating Diluted EPS step-by-step; Course 6 covers how to think about EPS; and Course 9 covers using EPS in valuation.

The reason Diluted EPS is the more commonly used form of EPS is because it factors into account potential dilution. Dilution occurs when a company issues additional shares of common stock. Dilution can decrease each share’s earnings. Therefore, analysts prefer to use Diluted EPS, which includes the potential impact of dilution.

Basic EPS is typically reported by companies in on the Income Statement.

Diluted EPS Formula

Here’s the formula to calculate Diluted EPS.

The formula is actually very simple. We simply take the company’s Net Income and divide it by the Diluted Weighted Average Shares Outstanding.

Diluted EPS Example

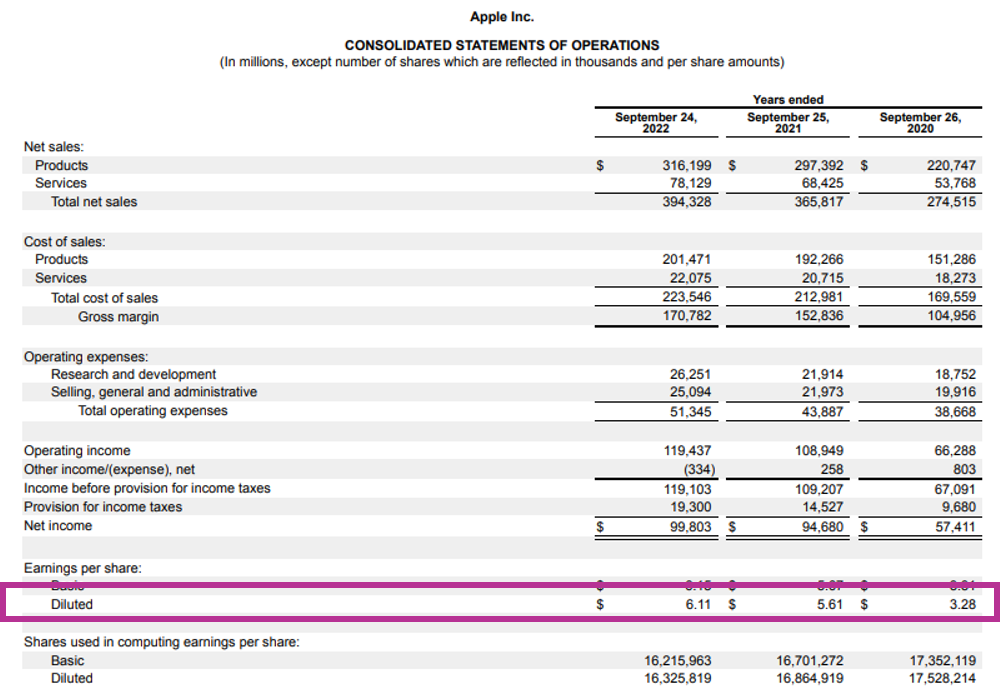

Let’s take a look at Apple. For the 2022 fiscal year (page 29), Apple reported $99.8 billion in Net Income and 16.33 billion Diluted WASO. To calculate Diluted EPS, we can divide the two numbers.

Diluted EPS = Net Income / Diluted WASO = $99.8 billion / 16.33 billion Diluted WASO.

Diluted EPS = $6.11 per share.

So, Apple’s Diluted EPS for the 2022 fiscal year was $6.11 per share. This means the company earned $6.11 of profit in 2022 for every share.

Most companies’ Diluted EPS is as simple as this. However, for a minority set of companies, there can be curveballs. In the next section, we’ll go over different curveballs that might arise when calculating Diluted EPS.

Impact of Preferred Stocks

The first curveball that can come up when calculating Diluted EPS is when the company in question has Preferred Stocks. The vast majority of companies don’t have Preferred Stocks. They only have Common Stocks. However, a small subset of companies has Preferred Stocks. These Preferred Stocks often have fixed dividends.

Recall that Diluted EPS measures the amount of Net Income a company earns for each of its common stock outstanding and common stock that will get created in the future. Conceptually, it measures the common stocks’ entitlement to profit. The common stockholders are not entitled to the portion of Net Income paid to preferred stockholders through dividends. Therefore, we have to subtract out the portion of Net Income that the company will pay to preferred shareholders.

Consequently, for companies with Preferred Stocks, the formula for Diluted EPS becomes as follows.

Diluted EPS = (Net Income – Preferred Dividends) / Diluted WASO

Impact of Non-Controlling Interest

The second curveball that can come up when calculating Diluted EPS is when the company in question has Non-Controlling Interest (see Course 10, Lesson 28). The vast majority of companies don’t have Non-Controlling Interest (NCI), so this doesn’t come up very often. Luckily, handling NCI in Diluted EPS is actually pretty simple.

Starting with Net Income including NCI, we subtract Net Income Attributable to NCI. This gives us the Net Income excluding Non-Controlling Interest, which is what’s attributable to the company’s common shareholders. Then, we divide this Net Income Attributable to Common Stocks by Diluted WASO to get Diluted EPS.

Diluted EPS = (Net Income – Net Income Attributable to NCI) / Diluted WASO

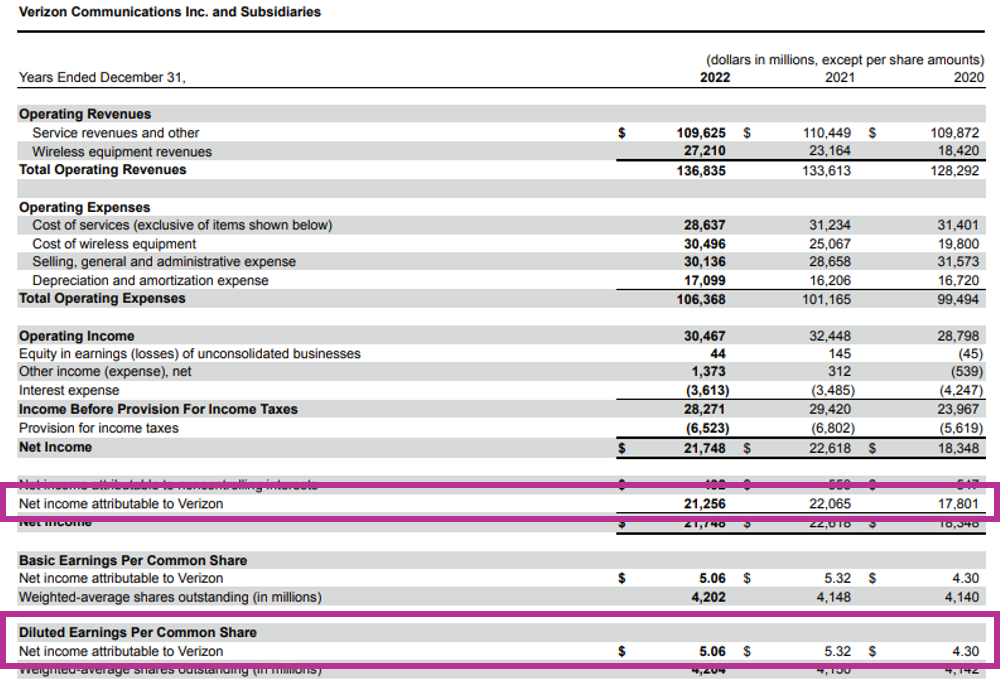

Verizon, for example, is a company that has Non-Controlling Interest. Here’s Verizon’s 2022 fiscal year Income Statement (page 54). The number you should use for Diluted EPS is the “Net Income Attributable to Verizon”, which was $21.256 billion. That’s the profit metric after deducting the earnings attributable to Non-Controlling Interest. Dividing $21.256 by 4.204 billion Diluted WASO equals $5.06 Diluted EPS.

Impact of Non-Recurring Items

The Diluted EPS that companies report on the Income Statement are usually GAAP numbers. They usually include one-time, non-recurring items. Ideally, you should adjust the reported Diluted EPS to neutralize the impact of these non-recurring items. This way, you get a normalized Diluted EPS that more accurately reflects the company’s ongoing earnings potential. Adjusting earnings is a pretty big topic on its own so we won’t dig too deep into it here.

Basic vs. Diluted EPS

The difference between Basic EPS and Diluted EPS lies in the number of outstanding shares used to calculate EPS.

Basic EPS divides the company’s Net Income by basic outstanding shares of common stock. This means that the company only takes into account the shares that are currently in existence.

Diluted EPS divides the company’s Net Income by diluted outstanding shares of common stock. This means that the company not only includes the shares that are currently in existence but also shares that will eventually come into existence in the future. In other words, Dilute EPS takes into account the potential impact of dilution on EPS. Dilution occurs when a company issues additional shares of common stock or securities that can be converted into common stock, such as stock options, warrants or units. These additional shares or securities will reduce the shareholders’ true EPS. As a result, most professional analysts use Diluted EPS to measure the company’s profitability on a per share basis. Our curriculum goes over the concept of dilution and how to calculate it in detail in Course 3.

To calculate Diluted EPS, the potential dilutive effect of these additional shares or securities is factored in. This is done using the “Treasury Stock Method” or the “If-Converted Method”. The two methods assume that the additional shares or securities are actually exercised or converted into common stock, and the proceeds are used to buy back outstanding shares of common stock.

By factoring in the potential dilutive effect of additional shares or securities, Diluted EPS provides a more conservative estimate of earnings per share than Basic EPS. Diluted EPS is typically lower than Basic EPS.

In summary, Basic EPS assumes that there are no potential dilutive securities outstanding. It only takes into account shares that currently exist. By contrast, Diluted EPS factors in the impact of dilutive securities that can create additional shares in the future. Consequently, Diluted EPS provides a more conservative and truer estimate of earnings per share.

Do You Use Basic or Diluted WASO for EPS?

Companies calculate Basic EPS using Basic WASO. Net Income divided by Basic WASO equals Basic EPS.

Companies calculate Diluted EPS using Diluted WASO. Net Income divided by Diluted WASO equals Diluted EPS.

Should You Use Basic or Diluted EPS?

For valuation analysis, you nearly always use Diluted EPS. You almost never use Basic EPS. We’re using “almost never” instead of a simple “never” to not be absolute. After all, never say never.

For example, let’s say you’re trying to calculate a company’s P/E multiple. In this case, you’d use the stock’s current stock price for the numerator and Diluted EPS for the denominator.

Using Basic EPS in the denominator would be a rookie mistake. Don’t do it.

How to Increase Diluted EPS

From an investor’s perspective, the higher the Diluted EPS the better. That’s because a higher EPS means the company is earning more profit for each share. If we own a company’s stocks, we naturally want the company to earn as much profit per share as possible.

So how can companies increase Diluted EPS? Well, based on the formula, there’re really two levers that companies can pull. They must either increase Net Income or decrease Diluted WASO.

To increase Net Income, they must either increase Revenue or decrease Cost. To increase Revenue, they must either sell more product units or raise pricing. To decrease cost, they must reduce at least one of Cost of Goods Sold, Operating Expenses, Interest Expense, or Taxes.

To decrease Diluted WASO, they must do share buybacks. Alternatively, companies can also find ways to let dilutive securities expire without causing dilution. Such methods could potentially be painful and so it’s debatable whether they’re beneficial.

These are the different ways companies can increase Diluted EPS.

Learn More

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.