In this article, we’re going to guide you through the Goldman Sachs HireVUE questions, particularly for investment banking and early careers. After you submit your online application, Goldman Sachs Human Capital Management (“HCM”) will review in the backend. If they choose to move you forward, you will receive an email with a link to the HireVUE interview. Clicking on the link will bring you to HireVUE’s website with your unique identification code.

How Goldman Sachs HireVUE Works

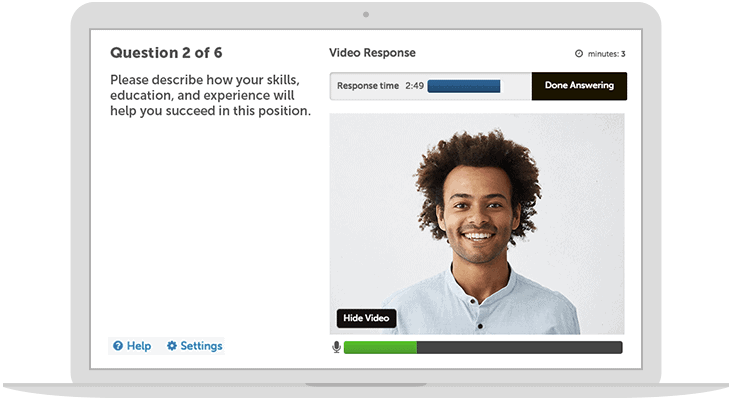

Once you arrive at the HireVUE website, the website will automatically test your microphone and your web camera. It’s a good idea to test these two devices and your Internet connection before starting HireVUE. Once that’s done, HireVUE will ask you if you’d like to do a practice question first. If you’ve never done a HireVUE interview before, you should absolutely take this practice question.

Once you finish the practice question, you can begin the actual HireVUE interview. In the real interview, HireVUE displays each question sequentially, one by one. You can’t jump ahead and you can’t go back. So you can only see the current question.

They’ll show you a question, after which you’ll have 30-45 seconds to prepare your answer. After the preparation time is up, the recording begins and you must deliver your answer. Historically, all Goldman Sachs HireVUE questions give candidates 2 minutes to answer each question. This may and likely will change time-to-time, so don’t follow this 2-minute budge religiously. After the recording ends, you have the option to watch your recorded answer to the question. You have one retry life for each question. Therefore, if you don’t like your recorded response for whatever reason, you can re-do it once. Once you submit your answer to the current question, the system will bring up the second question. This sequence repeats until you finish all questions.

So what are some real examples of Goldman Sachs HireVUE questions? That’s what we’ll show you next.

Goldman Sachs HireVUE Question #1

HireVUE Question: You are working on a highly confidential project with another manager and her work group. Your manager is not involved with the project and does not have access to this information. He asks you for access to the project’s results to help him make an important business decision. What would you do?

Lumovest Analysis: This question is testing whether you are someone who has enough awareness. There’re no rules that specify what you should operate in this situation. However, you should know that Goldman Sachs is very secretive about client information and project information. Sensitive information are shared internally only on a “need-to-know” basis. Anyone within Goldman Sachs who does not “need” to know the information should not obtain the information. Consequently, in this question, you have to balance navigating the manager relationship and protecting confidential information.

Sample Answer

In this scenario, I’m working on a highly confidential project with another group. My manager is not involved but asks me for the project’s results to help him make an important business decision. I know that as an employee of the firm, I have a responsibility to protect the information. One of the firm’s four core values is Client Service. It differentiates Goldman Sachs from competition by serving as a trusted advisor to clients. Part of that trust comes from protecting confidential information, both internally and externally. This is especially the case here since the project is emphasized to me as highly confidential. And so I would not tell him about the project results on the spot just because he’s my manager.

This is especially the case since it is uncertain whether the business decision is personal in nature. I’m mindful of the fact that he is my direct supervisor and so I think I should be very respectful. As a summer intern, I don’t think I would probe him about the nature of that business decision. If it’s personal, my question might embarrass him and make him feel self-conscious. And if it’s firm-related, it might involve other confidential information that I shouldn’t be privy to.

Rather, I would do two things. First, I would inform him that the group is very strict and protective of the results. Second, I would offer to bring up his request to access the results with the project manager. I think if he is asking on a “need-to-know” basis, he would be willing to speak with the project manager. And the project manager should decide whether to grant him access to the results. So that’s what I would do in this situation.

Goldman Sachs HireVUE Question #2

HireVUE Question: Provide an example of when you were in an unfamiliar setting with people from different experiences, perspectives, and backgrounds. What did you specifically do to create an inclusive environment?

Lumovest Analysis: Two things that Goldman Sachs really value are diversity and teamwork. The firm has one of the best track records of hiring diverse talent. Due to the nature of this diversity, its employees come from a wide array of backgrounds and experiences. HCM (Goldman’s HR) wants to know that you are someone who embraces diversity. It also wants to know that you are a good team player who makes other team members feel comfortable. Also, please note that you don’t have to position yourself as a leader in your answer to this question.

Sample Answer

In my freshman summer, I had studied abroad in the United Kingdom at the London School of Economics. Having spent all my life in the United States, the UK was completely foreign to me. The students in our summer exchange program are not locals. Rather, they come from all over the world, such as France, China, Germany, Argentina, Abu Dhabi, India, Russia, etc. It was very clear from the orientation events that my classmates come from a wide range of backgrounds and hold very different perspectives on life. We are all minorities in this program. I wasn’t a leader of our group by any means, but I did try to do my part.

To create a more inclusive environment for everyone, we took turns organizing study events and extracurricular activities and outings together. One time, after a group study session, the team wanted to grab dinner together in a popular area in London. Most of the students had already finished their work and so people started leaving towards the restaurant. But there were 3 other students from [Country A] who were still wrapping up their work. Because everyone else who left were not from [Country A], I was cognizant of how the 3 students might feel. I didn’t want the 3 remaining classmates to feel like we’re abandoning them. And so I volunteered to stay behind to wait alongside them until they finished. We then proceeded to walk towards the restaurant together. So this is a recent example of a situation where I contributed to a more inclusive environment.

Goldman Sachs HireVUE Question #3

HireVUE Question: What kind of barriers have you had to overcome in the past in order to be successful in a particular job or assignment? What was the situation? How did you deal with these barriers? What was the outcome? Please describe in detail.

Lumovest Analysis: Barriers could be any obstacles – disabilities, discrimination, financial disadvantage, family obligations, lack of resources, etc. Think of times when you’ve had to work hard to attain something. Try to spin that into an answer.

Sample Answer

I grew up in a remote town in Arizona, about 2 hours of drive outside of Phoenix. As a child, I was always a loyal viewer of WWE. Even though I’m a girl and I knew WWE was staged, it was still very interesting to me. But I never had a chance to really get into it and learn it.

But in 2016, I was watching the Rio Olympics and cheering for Team USA. That’s when I discovered wrestling as a sport. I had no idea that wrestling as an actual sport even existed because my middle school didn’t offer it. I was so excited about this sport and started following the Olympics wrestling games. Watching the women of Team USA win their gold medals was so motivating and inspirational. My parents always wanted me to pick up a sport, but I never felt a connection to any sport except this one. I was determined – I wanted to learn how to wrestle.

But where I grew up in Arizona, wrestling was not a very popular sport. People were a lot more into basketball, football, and even swimming due to the Arizona weather. I searched for wrestling classes near me but there is none. The nearest place that offered wrestling lessons was at a high school about an hour away. I was able to convince them to allow me to learn how to wrestle there.

The travel was very time-consuming. The back and forth took two hours every day but it felt very fulfilling. The travel is just one of the barriers. Because I’m was in middle school at the time, I had to wrestle students a few years older than me. But that didn’t discourage me. In fact, it motivated me to practice harder knowing my opponent is so much stronger. Eventually, I opted to attend this high school after graduating from my middle school and represented the school to win several district and state championships.

Goldman Sachs HireVUE Question #4

HireVUE Question: You are conducting a research study for a student organization to investigate the biggest challenges facing students at your school. You need to determine the best method for collecting this information from students and teachers. How would you decide on your method?

Lumovest Analysis: This question is really asking is you to demonstrate organization skills. Goldman is attempting to assess your ability to solve problems in a structured manner. You should identify the audience and then the criteria you will use to choose the best method.

Sample Answer

I’m conducting a research study on the biggest challenges facing students at my school and I have to determine the best method for collecting this information from students and teachers. First, I would study the school’s student body to make sure I collect from a sample set of students and faculty that’s somewhat representative of the school as a whole. That includes both undergraduates and graduates, students of different classes and different majors, and similar idea for the faculty.

There are many different ways we can go about collecting this information. As my second step, I would think through the constraints and requirements of this exercise. For example, I would consider things such as how quickly we need to gather this data, our budget, the scope of the challenges we’re looking for, whether they’re academic challenges or life challenges, convenience for the students and faculty, and motivation for them to speak the truth.

As my third step, I would brainstorm the different ways I can go about collecting this information. Once I have the different ways, I would set them up on a piece of paper side by side. I can compare these different methods based on the key constraints and requirements that I identified earlier. Based on this analysis, I can pick the method that best meet my needs.

Goldman Sachs HireVUE Question #5

HireVUE Question: What is your understanding of investment banking and why do you think your skillset is a good fit?

Lumovest Analysis: This question is division-specific. You won’t get this question unless you’re applying to the Investment Banking Division. However, you might get the equivalent of this question for whatever division you apply to. Even though the question didn’t mention it, you should also explain your interest. So the formula is: Interest + Skillset = Fit.

Sample Answer

My understanding of investment banking is that the firm advises clients on mergers & acquisitions and capital raising. In an M&A transaction, the firm would advise corporate clients on the purchase or sale of businesses. And in capital raising, the firm would help corporate clients raise capital either through issuing shares or by borrowing debt. The work requires putting together robust financial models, creating presentations and leading the due diligence process. It’s a very impact professional that requires strong analytical, work ethics and attention to details.

I’m very interested in investment banking because of the ability to make significant impact. Through M&A and financing transactions, investment banking can transform industries. It can help businesses obtain the capital they need to grow and create better products for the market. And I think that’s very meaningful.

Personality-wise, I’m a very analytical person. I’m currently double-majoring in Mathematics and Finance. I enjoy diving into the numbers to figure out the underlying story. I’m also very hardworking. In addition to my heavy course load at school, I also spent the last two summers interning at two different companies. The experiences taught me the importance of diligence, without which I can’t become better at what I do. And lastly, I’m very attentive to details. At the end of my last summer internship, my boss gave me a formal review. One of the things that he said I did really well was that I was thoughtful of the details.

And so in summary, I think I’m a good fit for this role because I’m very interested in the work and because I have good analytical skills, work ethics and attention to details.

Are There No Technical Questions?

Goldman Sachs HireVUE questions for students usually do not consist any technical questions. So HireVUEs for Summer Analysts and Summer Associates are almost always behavioral in nature. On the other hand, the Goldman Sachs HireVUE questions for experienced professionals may consist of technical questions. However, even in these situations, the technical questions are very simple and straightforward. Nothing complicated. In other words, you don’t have to worry about technicals for Goldman Sachs HireVUE questions.

Preparing for the Next Round after HireVUE

After you pass Goldman Sachs HireVUE questions, the next step is in-person interviews. These interviews can potentially be highly technical in nature. Having a strong finance technical foundation is a must.

Lumovest is the finest institution in the world to learn financial and investment analysis. Our courses are taught by Goldman Sachs investment banker. You’ll learn how to analyze financials and investments like how Goldman Sachs teaches its analysts and associates. Our lessons are interactive and visually intuitive. As a result, our courses are very practical and very relevant to what you’ll do on a day-to-day basis. By the end of the program, you’ll be able to conduct financial analysis on companies from the grounds up.

Developing a strong financial analytical skillset will help you stand out during the Goldman Sachs hiring process. Through our courses, you’ll learn accounting, financial modeling, LBO, DCF, M&A and valuation. At the end, you’ll receive an official blockchain-verified digital certification, which you can showcase on your resume. You can sign up here.

Related Readings