What are Long-Term Assets?

Long-Term Assets are assets that the company doesn’t intend or is unable to convert into cash within one year. This stands in contrast versus Current Assets which the company can convert into cash within one year.

The one year cutoff is usually the standard definition for Long-Term Assets. That’s because most companies have an operating cycle shorter than a year. However, for companies whose operating cycle is longer than one year, any Asset that the company doesn’t intend or is unable to convert into cash within the operating cycle should be classified as a Long-Term Asset. An operating cycle is the average period of time it takes for the company to produce the goods, sell them, and receive cash from customers. Any asset that isn’t a Current Asset must be a Long-Term Asset. For this reason, Long-Term Assets are also known as “Non-Current Assets”. We will use these two terms interchangeably.

Generally speaking, most companies have an operating cycle shorter than a year. Therefore, most companies use one year as the threshold for Current vs. Non-Current Assets.

Companies disclose all the Long-Term Assets they own and their values on the Balance Sheet. The one year period criteria is measured as 12 months from the date of the Balance Sheet.

Long-Term Assets List

Below is a list of Non-Current Assets that frequently appear on corporate Balance Sheets.

- Long-Term Investments: Stocks, bonds and other securities the company intend to hold for more than one year. Companies may also own equity in private companies that would require an extended sale process to liquidate into cash.

- Property, Plant & Equipment (PP&E): Land, buildings, buildings, machinery, equipment, furniture & fixtures, etc. Essentially, PP&E captures all the physical assets the company owns aside from inventory.

- Identifiable Intangible Assets: Patents, copyright, trademark, brand identity & logo, trade secret, customer relationships, etc.

- Goodwill: Unidentifiable intangible assets. Goodwill arises from buying another company at a price above the acquired company’s net asset value.

- Other Long-Term Assets: No uniform standard here and varies from company to company.

It’s important to note that not all companies will have all the above assets. Some might own other Non-Current Assets, in addition to the above. Others might own less. It varies from company to company.

Long-Term Assets Example

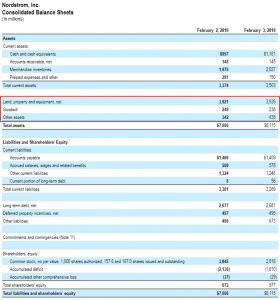

Here’s a real example of Long-Term Assets from Nordstrom’s Balance Sheet. We highlighted them with the red box. You can find Nordstrom’s Balance Sheet on page 37 of its annual report here.

Notice that whereas Current Assets is explicitly labeled and has its own subtotal, Non-Current Assets aren’t specifically labeled as such. Instead, companies just list Non-Current Assets underneath the Current Assets section. The Balance Sheet implies that any asset outside of the Current Assets section must be a Long-Term Asset. This is usually the case for most public companies’ Balance Sheets.

Fixed Assets

Long-Term Assets are often confused with Fixed Assets. Long-Term Assets refer to assets that the company doesn’t intend or is unable to convert into cash within one year. By contrast, Fixed Assets refer to tangible physical assets with a useful life longer than one year. Fixed Assets is also known as Property, Plant & Equipment, or PP&E. Fixed Assets is just one of several Long-Term Assets. So while Long-Term Assets include Fixed Assets, the two are not synonymous.

LT Assets Impact on Business Quality

Non-Current Assets such as PP&E and Intangible Assets form the backbone of every company. These assets, such as computers, office furniture & fixtures, trademarks, and patents, enable businesses to sell their products. Companies that have significant Long-Term Assets driven by PP&E or intangible assets are generally capital-intensive. That’s because it takes lots of capital to acquire or these assets. A PP&E of $100mm on the Balance Sheet means the company had spent $100mm or more to acquire it. This means the business needs to spend a lot of money in order to make sales and generate profits. All else equal, businesses that can generate the same earnings with less Long-Term Assets are superior. They are run more efficiently and can earn profits with less capital investments. Therefore, all else equal, investors prefer to invest in non-capital intensive businesses.

Relationship with Other Financial Statements

Income Statement and Cash Flow Statement impact Long-Term Assets. Some examples of how they’re connected are:

- Purchases or Sales of Securities (Cash Flow Statement) can increase or decrease the value of Long-Term Investments.

- Capital Expenditures (Cash Flow Statement) and Depreciation (Cash Flow Statement) drive PP&E.

- Divestitures (Cash Flow Statement) and Gain / Loss on Sale of Asset (Income Statement) also affect PP&E.

- Amortization (Cash Flow Statement) impacts the value of Intangible Assets on the Balance Sheet.

- Acquisitions, Net of Cash Acquired (Cash Flow Statement) can increase PP&E, Intangible Assets and Goodwill.