GFIA™ gives you practical knowledge.

We provide you the skillset possessed by star analysts of Wall Street’s top firms.

We provide you the skillset possessed by star analysts of Wall Street’s top firms.

GFIA™ can be included on your resume and LinkedIn profile, which will prove your financial knowledge.

The GFIA™ curriculum covers all the key concepts commonly tested in finance interviews.

You will develop highly practical knowledge that you can use on the job to stand out from peers.

How do you find information on companies? Where do you find information about a company’s financials, such as its revenue, expenses, cash flow, assets, and liabilities? Where should you begin the research?

By the time you become a GFIA™, you will know exactly where to find the information you need and how to analyze businesses in a structured manner.

Building Discounted Cash Flow (DCF) models is an important task for financial analysts. It’s how we determine the intrinsic value of a company.

As a GFIA™, you will be able to confidently build DCF models. You’ll understand the different components in a DCF, such as UFCF and WACC. You’ll also be able to flexibly adjust between different terminal value methodologies.

What are the different line items on the financial statements and what do they represent? How do you extract meaningful insights from the financial statements? How do you project future financials?

As a GFIA™, you’ll be able to analyze financial statements to understand the real story about a company. You’ll also be able to forecast financials in a scientific manner.

Knowing how to build Leverage Buyout (LBO) models is a requirement for candidates who want to pursue a career in investment banking or in private equity.

As a GFIA™, you will become very familiar with LBO models. You’ll understand how LBOs work, why they are profitable and be able to comfortably build LBO models from start to finish through a structured and organized approach.

Valuation is at the heart and soul of financial analysis. How do you determine what the different businesses and their stocks are truly worth? What are the different metrics that analysts use to measure valuations?

By the time you become a GFIA™, you will be able to value companies and stocks using a wide range of valuation methodologies.

As a GFIA™, you’ll have a strong grasp of the composition of different companies’ capital structure. You’ll understand the different tranches of debt, their common characteristics, and be able to model them in Excel.

You’ll also understand how the different debt tranches can affect a company’s cash flow obligations and valuation.

Mergers & Acquisition (M&A) are very prevalent. Companies around the world execute M&A transactions worth trillions of dollars every year. Understanding the dynamics of M&A is essential to a successful career in finance.

As a GFIA™, you’ll possess a deep understanding of how M&A transactions work. You’ll be able to build M&A model from start to finish and understand the levers that drive key metrics.

Knowing the different lines on the 3 financial statements and how they are connected is not enough. A successful financial analyst today needs to be able to build a fully-integrated 3-statement financial model.

GFIAs can build full-blown 3-statement financial models. You’ll know how to link the different lines with one another and diagnose hidden problems that plague many analyst models.

GFIA™ will help candidates recruiting for roles in M&A, industry coverage and capital markets groups.

GFIA™ will help candidates recruiting for buyside investing roles in private equity, hedge funds, and venture capital.

GFIA™ will help candidates recruiting for roles in mutual funds, asset management, and private wealth management.

GFIA™ will help candidates recruiting for roles such as corporate development, corporate treasury, financial planning & analysis, and investor relations.

“I was asked multiple interview questions about capital structure considering the fact that it’s a shop that does a lot of distressed investing. I believe I fared well with the questions, but I would have been much more crisp/refined in my responses if I’d been able to go through the Lumovest GFIA™ modules.”

– Citi Investment Banking Analyst

Sign up is super easy. Just a few clicks and you’re on Step 2.

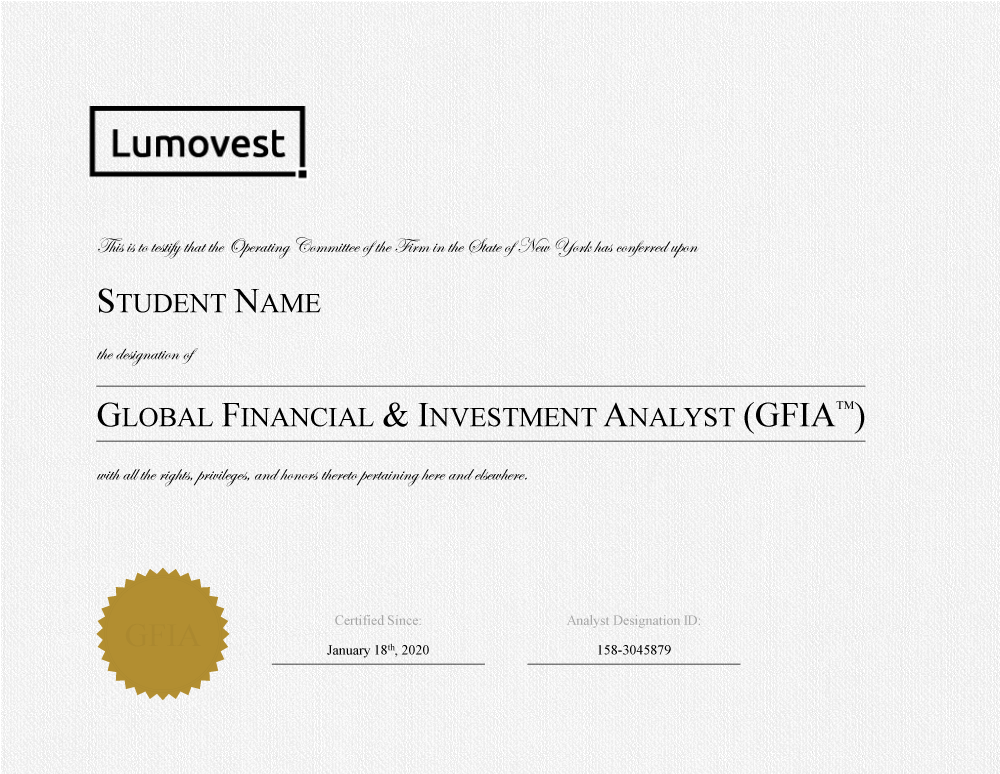

To receive the Global Financial & Investment Analyst (GFIA™) designation, you have to complete all the required courses.

Once all courses are completed, you will receive Lumovest’s Blockchain-Verified GFIA™ certification within 2 days.

Employers can contact Lumovest to verify your credential and

we will verify it for you free of charge.

Students in leading universities around the world use Lumovest’s GFIA™ curriculum to prepare for interviews.

Professionals at the top global firms use Lumovest’s GFIA™ curriculum to succeed in their jobs and become a star analyst.

Starting at just