Overview of Investment Banking in China

Investment banking in China is a high growth profession, in terms of (i) deal flow, (ii) prestige and (iii) compensation. Driven by its gigantic economy and an increasingly sophisticated financial system, China has developed a thriving investment banking industry.

Similar to the industry elsewhere in the world, the core services of investment banking in China are M&A and financing. China has the world’s second largest M&A market by transaction value, over US$700 billion. In addition, China is home to some of the world’s largest companies, such as Alibaba and Tencent. Naturally, China also has one of the world’s largest financing markets.

List of Top Investment Banks in China

Broadly speaking, there are two types of investment banks in China.

First, there are the global investment banks. These are usually the bulge bracket American and European investment banks. The American investment banks (i.e. Goldman Sachs, Morgan Stanley, J.P. Morgan) are the most prestigious in the Chinese market. Second, there are the native Chinese investment banks. These are domestic banks cultivated in China.

The global investment banks have greater scale, greater resources, and greater brand recognition than the domestic Chinese investment banks. That’s because these global banks operate worldwide and therefore have access to more resources. As a result, prior to the mid-2010s, the global investment banks dominated the Chinese investment banking industry. The global investment banks were and (still are) considered the most prestigious firms. As a result, they historically obtained the most attractive mandates. They win the most deal flow and they also pay their employees the most.

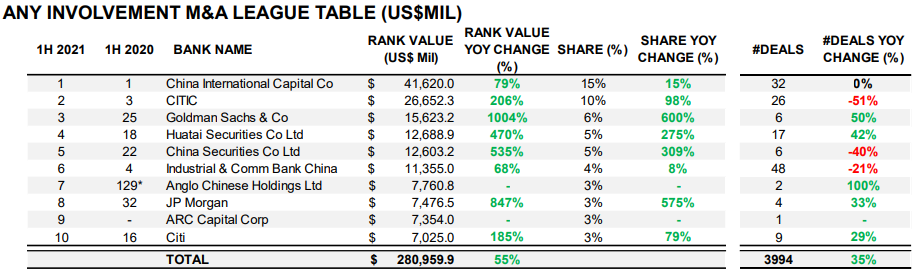

However, by 2021, the Chinese investment banks have made significant progress catching up in their home market. In many cases, the Chinese investment banks surpassed the global investment banks in terms of China deal flow. For example, over 1H’2021, the Chinese investment banks executed more deals in China than their global peers. In China M&A, CICC’s transaction value was more than double that of Goldman Sachs.

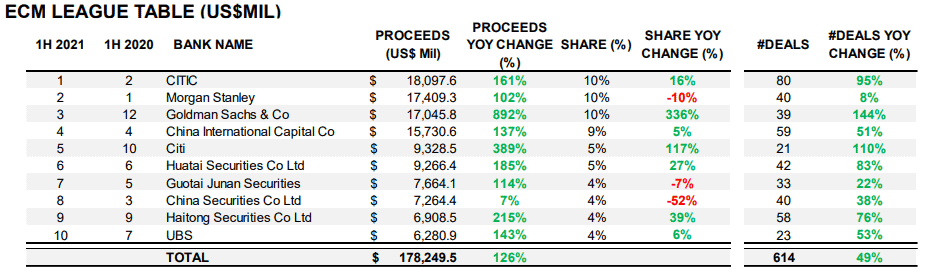

In China Equity Capital Markets (ECM), the league table was filled with Chinese investment banks. Among the global investment banks, only Goldman Sachs, Morgan Stanley, Citi and UBS made it to the top 10.

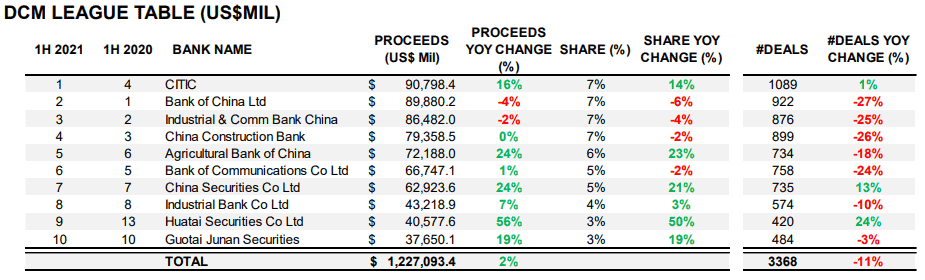

In Debt Capital Markets (DCM), none of the global investment banks broke into the top 10. The credit market was dominated by the Chinese investment banks.

Global Investment Banks

Even though the global investment banks have waning market share in China, their China businesses are still growing. That’s because the Chinese financial markets and economy are growing. Consequently, the global banks are earning more profits from investment banking in China even though their market share is declining. In addition, these global corporations are still considered the most prestigious. Beyond reputation, they also pay the highest compensation.

- Bank of America (美国银行) (美银)

- Barclays (巴克莱)

- Citigroup (花旗)

- Credit Suisse (瑞士信贷) (瑞信)

- Deutsche Bank (德意志)

- Goldman Sachs (高盛)

- J. P. Morgan (摩根大通) (小摩)

- Morgan Stanley (摩根士丹利) (大摩)

- UBS (瑞银集团) (瑞银)

Chinese Investment Banks

The domestic Chinese investment banks significantly increased their capabilities over the past two decades. Not only did they grab market share away from the global investment banks, but they are also expanding overseas.

- China International Capital Corporation (CICC) (中金)

- China Securities (中国证券)

- CITIC Securities (CITIC) (中信)

- Guotai Junan Securities (GTJA) (国泰君安)

- Haitong Securities (海通)

- Huatai Securities (华泰)

- Industrial and Commerce Bank of China (ICBC) (工商银行)

Salary for Investment Banking in China

Compensation for investment banking in China is pretty straightforward.

The global investment banks have “global pay”. Investment banking analysts in China can expect ~US$100,0000 to US$125,000 as their base salary. Using an USD-RMB exchange rate of 1.0 to 6.4, that’s about ¥640,000 to ¥800,000. In addition to the base salary, the firms also pay year-end bonus, which can be another US$100,000 (¥640,000). In total, a first-year analyst can earn over ¥1 million. Same story for investment banking associates.

By contrast, the Chinese investment banks have “domestic pay”. This pay is significantly lower than that of the global investment banks. That’s because domestically, the Chinese cost of living is much lower. Leadership of the Chinese banks also have to be mindful of the political and social implications. Therefore, the compensation package from the local Chinese investment banks are usually far lower. A first-year investment banking analyst may earn less than ¥500,000. In USD terms, that’s less than US$80,000. Among the domestic banks, CICC and CITIC probably pay the highest.

Hong Kong vs. Mainland

Historically, the global investment banks covered Chinese clients from the Hong Kong office. Some also have an IBD office in Beijing through a joint venture. For example, Goldman Sachs was in a joint venture with Gaohua Securities. The joint venture was known as Goldman Sachs Gaohua (高盛高华) in which Goldman Sachs only owned 51% of the Beijing operations. However, in 2021, the Chinese government granted approval for the global investment banks to acquire full ownership of their Mainland operations. Goldman Sachs, for example, reached agreement to acquire the remaining 49% of Goldman Sachs Gaohua. In addition, the Chinese government is also making it easier for global investment banks to operate in the Mainland. As a result, the global investment banks are now expanding beyond Mainland. They relocated bankers from Hong Kong to Mainland and are increasing their investment banking teams in the Mainland.

By contrast, the Chinese investment banks have always had a sizable presence in both Mainland and Hong Kong.

The location distinction between Mainland and Hong Kong has important implications on compensation for investment banking in China. First, the pre-tax compensation package is generally higher in Hong Kong than that in Mainland. In other words, for the exact same role, the pay is higher in Hong Kong than it is in Mainland. That’s partially because Hong Kong has a much higher cost of living. Second, the personal income tax rate is much higher in Mainland (up to 45%) than it is in Hong Kong (up to 20%).

Breaking into the Industry

Similar to the situation in other investment banking markets, it is very competitive to break into investment banking in China. Statistically, recruiting is even more difficult than in the United States just because China has a much larger population.

To break into investment banking in China at a top firm, you should try to attend a feeder school. That’s the standard and the most common way to enter into the industry.

However, there’s a separate way to break into the industry. The culture in China is very connection-driven. A large part of a candidate’s success is based on who the candidate knows or who the candidate’s parents know. If you have strong connections, you have a huge leg up in the recruiting process. If you don’t have strong connections, the best way is to attend a feeder school.

Feeder Schools

There are three types of feeder schools to break into China investment banking. The first type of feeder are top schools in the United States, United Kingdom, and Canada. Highly ranked public universities, such as Harvard and Stanford, as well as public universities, such as the University of Michigan and UC Berkeley are very prestigious in China. The second type of feeder are top schools in the Mainland, specifically 985 and 211 universities. Among these universities, Tsinghua, Peking, Fudan and Shanghai Jiao Tong (清北复交) have an outsized representation. The third type of feeder are top schools in Hong Kong. They are the University of Hong Kong (HKU), Chinese University in Hong Kong (CUHK) and to a lesser extent, Hong Kong University of Science & Technology (HKUST).

Investment Banking Course

In addition to attending a feeder school or having the right connections, candidates also need to know financial analysis. Our courses are taught by Goldman Sachs investment banker. We designed our courses to prepare you for investment banking. We teach you how to conduct financial analysis like how it’s done on Wall Street.

Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.