What is “Accumulated Other Comprehensive Income”?

Accumulated Other Comprehensive Income (AOCI) represents the cumulative total of gains and losses not yet recognized on the Income Statement. We go over this topic in greater detail in our finance curriculum: Course 10 – Lesson 27.

Why can’t companies recognize some gains and losses on the Income Statement? Because in order for companies to record gains and losses on the Income Statement, they must realize them. If they realize the gains and losses, they may record them on the Income Statement. If the gains and losses are unrealized, companies may not record them on the Income Statement.

In other words, AOCI represents the cumulative unrealized gains or losses from transactions or events not included in Net Income. On the financial statements, AOCI appears as its own line item under the Shareholder’s Equity section.

Examples of items that can impact AOCI include foreign currency translation gains and losses, changes in the fair value of certain financial instruments, and adjustments for certain post-employment benefits.

AOCI is important because it can have a significant impact on a company’s financial statements and overall financial position. For example, if a company has significant unrealized gains in its investments, companies would reflect these gains in AOCI. Over time, these gains would eventually flow into Net Income. This can make the company appear less profitable today than it actually is.

AOCI can also impact a company’s financial ratios and metrics, such as Return on Equity (ROE). This is because Shareholder’s Equity (denominator in EPS) includes AOCI.

Overall, AOCI is an important concept to understand for investors and analysts. By understanding AOCI, investors can gain a better understanding of the impact unrealized gains & losses may have on the company’s financial statements over time.

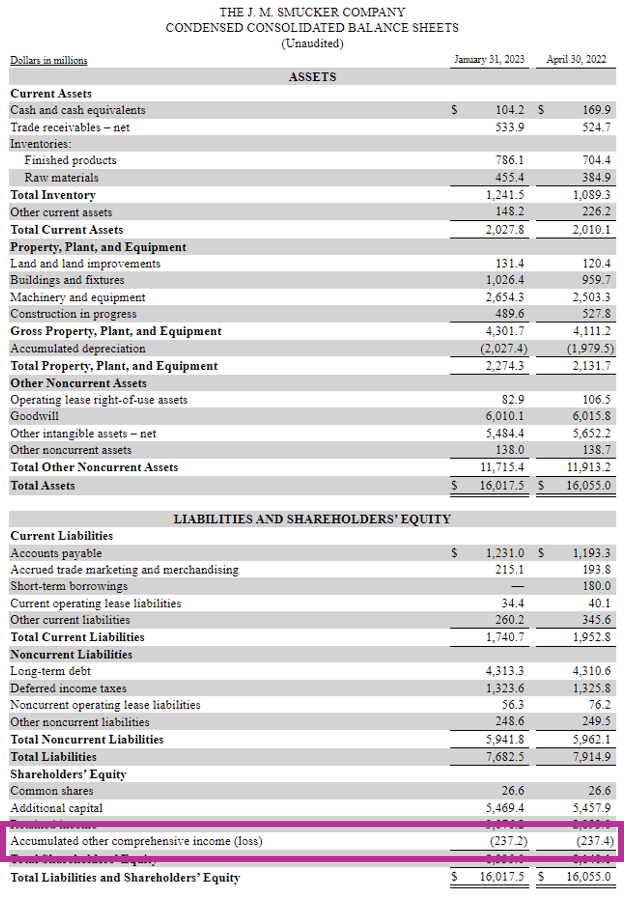

Here’s how Accumulated Other Comprehensive Income appears on the Balance Sheet for J.M. Smucker.

Accumulated Other Comprehensive Income Examples

So now we understand what AOCI is. Let’s look at some examples of things that go into Accumulated Other Comprehensive Income.

Foreign Currency Translation Gains and Losses: Let’s say a company has operations in several countries with different currencies. This is very common among big corporations. In this case, it will need to translate the financial statements of those operations into the company’s reporting currency. Companies include the resulting foreign currency gains or losses in AOCI.

Unrealized Gains and Losses on Investments: Let’s say a company has investments in securities such as stocks or bonds. Companies include the unrealized gains or losses on those investments in AOCI until they realize these gains or losses.

Pension Liability Adjustments: Changes in the value of a company’s pension plan assets and liabilities can impact AOCI. For example, let’s say a company’s pension plan assets increase in value. The company may include the resulting gain in AOCI until it realizes the gains in some way.

Derivative Financial Instruments: Changes in the fair value of certain derivative financial instruments can impact AOCI until they are settled. Examples of common derivative financial instruments that public companies have include interest rate swaps or commodity futures contracts.

These are some examples of items that go into AOCI.

Accumulated Other Comprehensive Income Formula

Now let’s look at an AOCI example with some numbers. In general, we can calculate AOCI as the sum of Foreign Currency Translation Losses, Changes in Fair Value of Financial Instruments, and Pension Liability Adjustments.

Let’s say a company has the following items that impacted AOCI over time:

Foreign Currency Translation Losses: $(5) million

Unrealized Gains on Available-for-Sale Securities: $10 million

Pension Liability Adjustments: $2 million

Applying the above formula, AOCI equals $10 million – $5 million + $2 million, which equals $7 million. Thus, AOCI for this company is $7 million.

Negative AOCI

It’s called “Accumulated Other Comprehensive Income” if the cumulative number is positive, meaning there’s a net gain. However, if the cumulative number is negative, it means there’s a net loss. In that case, it’s called “Accumulated Other Comprehensive Losses”.

To simplify things, companies often call this line item “Accumulated Other Comprehensive Income & Losses”.

AOCI Accounting Rules

There are several accounting rules that apply to Accumulated Other Comprehensive Income (AOCI). Here are a few key points to keep in mind:

- AOCI is reported on the Balance sheet, under the Shareholder’s Equity section.

- Items included in AOCI are typically unrealized non-operating gains and losses. AOCI includes gains and losses that are not part of a company’s core business operations. These items are things such as foreign currency translation gains and losses or unrealized gains and losses on investments.

- AOCI is subject to reclassification. As companies realize the gains and losses in AOCI, they may reclassify the items from AOCI to Net Income. For example, accounting rules require companies to reclassify gains or losses on available-for-sale securities from AOCI to Net Income when they sell the securities.

- AOCI is subject to amortization. In some cases, items that companies include in AOCI may be subject to amortization. For example, companies amortize pension liability adjustments over time as they pay off pension obligations.

- AOCI is a part of Comprehensive Income. Comprehensive Income is a broader measure of a company’s financial performance that includes gains and losses not in Net Income.

These are some accounting rules that apply to AOCI.

Learn More

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.