What is Average Revenue per User (ARPU)?

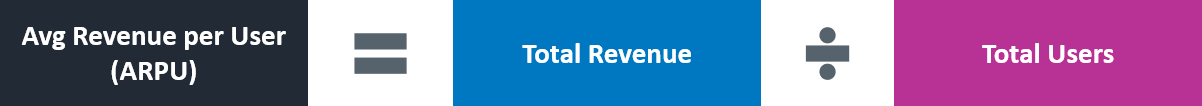

Average Revenue Per User (ARPU) is a financial metric that measures how much revenue on average each user generates. ARPU evaluates the revenue generation performance of companies that provide subscription-based services. We can calculate ARPU by dividing the total revenue by the number of users or subscribers during the same period.

For example, let’s say a streaming service provider has 1 million subscribers and generates $10 million in revenue. To calculate its ARPU, we would divide the $10 million by 1 million, giving us an ARPU of $10. This means that on average, the company earns $10 from each user.

ARPU can be calculated for any type of subscription-based business. Some examples include streaming services, mobile applications, and software-as-a-service (SaaS) providers. It is a valuable metric for investors and analysts because it provides insight into the monetization performance of these businesses.

Why is ARPU Important?

ARPU is an important metric for businesses that offer subscription-based services because it provides insight into the company’s monetization ability. By tracking ARPU over time, companies can assess whether their pricing strategy is effective, and whether they are successfully increasing revenue through the acquisition of new subscribers or the retention of existing ones.

Average Revenue per User can also help companies understand their customer base and identify opportunities for growth. For example, if a company has a high ARPU relative to competitors, it may indicate that its customers are willing to pay more for its products or services. Conversely, if a company has a low ARPU relative to competitors, it may indicate that it’s underpricing its products or for whatever reason, customers aren’t willing to pay more.

Take, for example, Netflix and Disney. In the quarter ended September 2022, Netflix reported $11.85 of ARPU among its global viewers (page 20). In the same period, Disney+ reported only $3.91 of ARPU among global viewers (page 6). This indicates that Disney’s ability to monetize its viewers is weaker than that of Netflix. This could be due to customers not willing to pay the same price for Disney+. It could also be due to Disney undercharging customers. The ARPU metric can help the analyst identify the gap between Netflix and Disney. However, it’s up to the analysts to identify the cause, which will then become part of their investment thesis.

ARPU is also important because it’s a driver of revenue. Mathematically, ARPU times number of users equals total revenue. Naturally, to increase revenue, companies must increase ARPU, number of users, or ideally both. Thus, we can see that ARPU is an essential driver of revenue. As we explain in Course 4 of our curriculum, revenue growth is absolutely critical in investment analysis.

ARPU Formula

How do we calculate ARPU? Here’s the formula.

For example, if a company has $100 million in revenue and 200,000 users, then it has $500 ARPU.

By now, you should understand that ARPU is a very important metric. Perhaps due to its importance and popularity, there are now many variations of this formula.

The first variation is Average Revenue per Paying User. Instead of dividing total revenue by all users, this variation divides total revenue solely by paying users. It completely excludes non-paying users.

The second variation is to calculating Average Recurring Revenue per User. Instead of calculating ARPU off of total revenue, this variation uses the amount of revenue that’s recurring in nature. It excludes non-recurring revenue.

There are many other variations as well, but they’re largely conceptually similar. For example, another variation is to divide total revenue by active users only instead of all users. While some companies present annual ARPU, other companies calculate monthly ARPU.

Regardless the variation, the underlying concept is the same – it measures a company’s monetization ability.

Industries That Use ARPU

ARPU is commonly used in industries that offer subscription-based services. In these industries, customers pay a recurring fee for access to products or services. Some examples of industries that use ARPU are as follows.

- Streaming Services: Streaming services such as Netflix, Hulu, and Disney+ use ARPU to measure the revenue generated from their subscribers.

- Telecommunications: Telecommunication companies such as AT&T and Verizon use ARPU to track revenue generated from mobile phone subscribers.

- Video Games: Video game companies such as Electronic Arts and Activision Blizzard use ARPU to measure the revenue generated by their player base, particularly in games that offer subscription-based services or in-game purchases.

- SaaS Providers: Software-as-a-service (SaaS) providers such as Salesforce and Adobe use ARPU to track the revenue generated by their subscribers. Software subscribers pay for access to cloud-based software products.

- Music Streaming: Music streaming services such as Spotify and Apple Music use ARPU to measure the revenue generated from their subscribers who pay for access to ad-free streaming and other premium features.

Overall, ARPU is a widely used metric that helps businesses and investors understand the revenue model. It helps them understand the company’s monetization and identify opportunities for growth and optimization.

How to Increase ARPU

As explained above, ARPU is particularly important because it’s a driver of revenue. ARPU times number of users equals revenue. Naturally, companies want to increase their ARPU as part of the effort to increase revenue.

But how can companies increase ARPU? Here are some levers companies can pull to increase Average Revenue per User.

First, companies can increase price. Assuming volume doesn’t decline materially, increasing price will increase ARPU. Some companies can simply increase prices because they’re currently underpricing their offerings. As a result, their products appear as a “steal” to users. For other companies, they may need to roll out new features to justify the price increase.

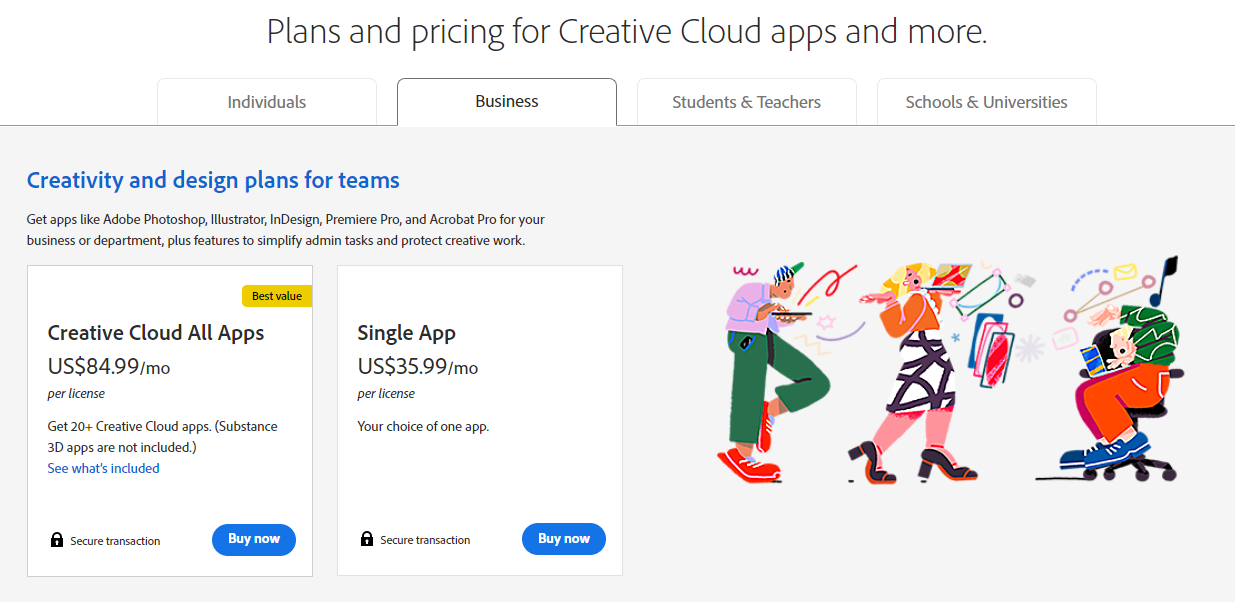

Second, companies can encourage users to buy the more expensive plans instead of the cheaper plans. This changes the revenue mix and the higher priced plans will lift up ARPU. For example, take a look at Adobe’s pricing plans below.

Adobe can try to convince more paying customers to buy the “Creative Cloud All Apps” instead of “Single App”. This will shift revenue mix towards more expensive plans and increase ARPU.

Third, companies can add add-on premium features for purchase. For example, game producers often have items in games that users can purchase. This is in addition to whatever base price that the user is paying (if any).

And lastly, companies can try to attract more affluent users. These customers are less price sensitive and winning over this customer segment can significantly boost revenue.

Learn More

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.