What is “Acquisitions, Net of Cash Acquired”?

“Acquisitions, Net of Cash Acquired” is a common line on the Cash Flow Statement. It measures the net amount of cash a company spent to acquire other companies. For example, suppose a company’s Cash Flow Statement shows $500 million for “Acquisitions, Net of Cash Acquired”. This means the company used $500 million of cash to buy other companies.

Most for-profit companies want to grow. Growth allows the companies to earn more profits and generate greater return for their shareholders. Companies can grow organically by building their own operations or grow inorganically by acquiring other companies. The latter is known as “Mergers & Acquisitions” or M&A for short. M&A is very popular. Each year, thousands of M&A transactions worth trillions of dollars take place around the world. Many companies purchase other companies to become larger and strengthen their competitive position in the industry. In order to make the transactions happen, the buyers have to pay the sellers. In most instances, buyers pay the sellers with cash. How much cash? That’s what the line “Acquisitions, Net of Cash Acquired” measures.

Why does “Net of Cash Acquired” mean?

The first half (“Acquisitions”) of “Acquisitions, Net of Cash Acquired” is very intuitive. It clearly indicates that the cash is being spent on acquisitions. However, what about the second half (“Net of Cash Acquired”)? Why does the name include it and what does that even mean?

Companies have their own business bank accounts. Nike has its bank accounts and Netflix has its own bank accounts. Just like regular people, companies keep their cash in these bank accounts. When Company A acquires Company B, Company A becomes the owner of Company B. Therefore, Company A owns all of Company B’s assets, including the cash in Company B’s bank accounts. Post the acquisition, the cash in Company B’s bank accounts now belongs to Company A. This is “Cash Acquired”. This acquired cash effectively reduced the net amount of cash Company A spent to acquire Company B.

For instance, suppose Company A paid $100 million to acquire Company B. Company B has a bank account with $20 million of cash. After the acquisition, Company A owns Company B, including the $20 million of cash in the bank. While Company A paid $100 million of cash to buy Company B, it later gained ownership over $20 million. Therefore, Company A effectively only spent $80 million to acquire Company B. The $100 million is “Acquisitions”. The $20 million is “Cash Acquired”. And the $80 million is “Acquisitions, Net of Cash Acquired”.

Companies pay cash upfront to acquire other companies but receives some cash in return. Therefore, accounting requires companies to net out the acquired cash. That’s why the name includes “Net of Cash Acquired”.

Example on the Cash Flow Statement

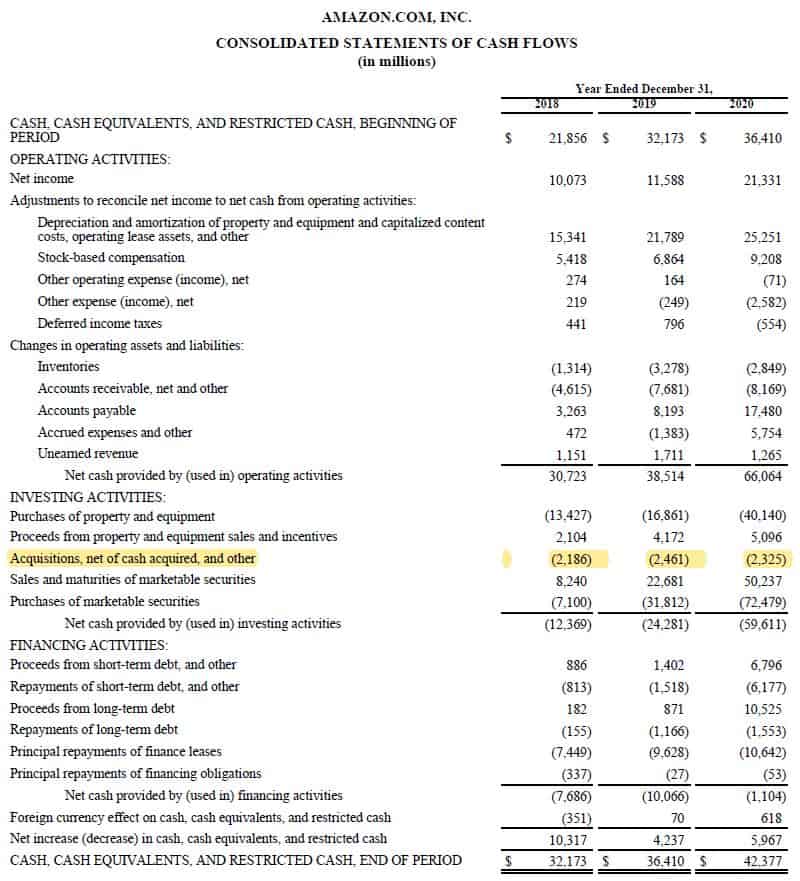

“Acquisitions, Net of Cash Acquired” is a very common line item on the Cash Flow Statement. It appears under Cash Flow from Investing. Sometimes, this line may appear as “Business Acquisitions”, “Payments Made in Connection with Acquisitions” or other similar variations. Because it represents cash outflow, it usually appears on the statement as a negative number. Here’s an example of Amazon’s Cash Flow Statement.

This line is distinct and separate from “Purchases of Marketable Securities”. “Purchases of Marketable Securities” represents the amount of cash a company invested in liquid securities, such as stocks and bonds. It’s merely investing some of its cash in securities instead of keeping it in the bank to earn better returns. These securities make up a minuscule percentage of other companies. In an acquisition, however, the company spends cash to purchase the entirety or close to entirety of another company.

Financial Implications of “Acquisitions, Net of Cash Acquired”

When the acquiring company buys a target company and gains control, it must consolidate the target company’s financials. Consolidation requires the acquiring company to include the target’s financials in its own financials. For example, suppose the acquiring company has $3 million revenue and the target company has $1 million. Consequently, the acquirer has to consolidate the financial statements and report $4 million in revenue.

As a result, there are important implications of “Acquisitions, Net of Cash Acquired” on the financial statements. The mere existence of this line indicates that the company made acquisitions. This means that the numbers on the financial statements include the numbers from the target company. This could cause significant jumps in values on the Income Statement, Cash Flow Statement and the Balance Sheet. For instance, in the example above, revenue increased from $3 million to $4 million, which represents a 33% increase. Therefore, whenever you see “Acquisitions, Net of Cash Acquired”, know that some of the large jumps are attributable to acquisitions.

Conclusion

In conclusion, “Acquisitions, Net of Cash Acquired” measures the net amount of cash a company spent to acquire other companies. It usually appears on the Cash Flow Statement under Cash Flow from Investing as a negative number.