What are Capital Expenditures (CapEx)

Capital Expenditures (CapEx) is the cash a company pays for capital assets that will deliver long-term value to the business. These capital assets usually consist of (1) PP&E and (2) Intangible Assets. PP&E are physical assets, such as buildings, office fixture, cash registers, machinery, etc. Intangible Assets are things like patents and software. Companies makes these spending with the intention of improving or expanding the business, increasing efficiency, or maintaining competitive advantage.

If a company spends $500 buying desks and chairs for its employees, it’d record the $500 as CapEx. Likewise, if a gas station spends $10,000 buying a new gas machine, it’d record the $10,000 as CapEx.

In most instances, companies spend Capital Expenditures mostly on physical assets, such as buildings, machineries, and equipment. A common misconception is that Capital Expenditures only include spending on physical assets. This is not true. Capital Expenditures are expenditures related to capital assets, which are assets that drive the company’s long-term growth. These capital assets may include both PP&E and Intangible Assets. Both PP&E and Intangible Assets enable the business to operate and generate value over the long-term. Therefore, Capital Expenditures include cash spent on both PP&E and Intangible Assets.

However, in practice, many companies spend most of their Capital Expenditures on PP&E. That’s because physical assets often require ongoing maintenance. As a result, in practice, CapEx mostly relate to spending on physical assets.

Capital Expenditures can be categorized into two main types: Growth Capex and Maintenance Capex. Growth CapEx are spendings to expand the business, such as opening new locations, launching new products, or upgrading technology. On the other hand, Maintenance CapEx are investments to maintain the existing business, such as repairing machinery or replacing equipment.

How CapEx Appears on Financial Statements

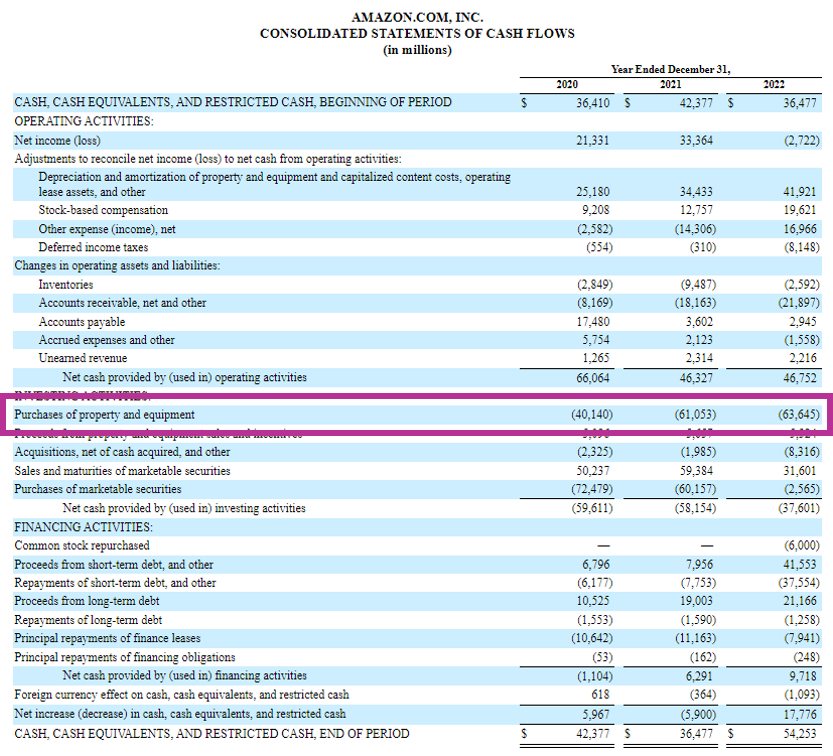

Capital Expenditures is a line item on the Cash Flow Statement. It usually appears as a cash outflow under Cash Flow from Investing. When companies spend cash to buy capital assets, they are making an investment. They are investing into their core business operations. Therefore, it’s categorized as an investing activity.

Companies that spent all of their CapEx on physical assets will call it “Purchases of Property, Plant and Equipment” or “Purchases of Physical Assets” instead of “Capital Expenditures”. Regardless, the terms are conceptually similar.

Here’s an example from Amazon (10-K page 36).

Remember, CapEx is the cash the company spends on long-term assets. The long-term assets acquired through CapEx recorded on the Balance Sheet, usually in the line item “Property, Plant & Equipment”. These assets depreciate over their useful lives. Useful life is the estimated period of time that the asset will generate benefits for the company. The Depreciation expense is then recorded on the Income Statement and Cash Flow Statement as a non-cash expense.

Capital Expenditures are a key component of a company’s financial management as they can impact the company’s cash flow. Properly managing CapEx is important to ensure the company is investing in the right projects to drive growth and profitability.

Capital Expenditure Examples

Here are some CapEx examples.

Property: A company may invest in real estate to expand its facilities, build new locations, or purchase land.

Equipment: A company may invest in machinery or other equipment to improve production efficiency, increase capacity, or upgrade existing equipment. Examples of equipment include machinery, computers, phones, cash registers, shelves, etc.

Office Furniture & Fixture: A company may invest in things for the office, such as desks, chairs, sofa, conference call technologies, etc.

Technology: A company may invest in software, hardware, or other technology.

The above are some broad examples of CapEx. However, it’s equally important to understand what’s not considered CapEx. Purchase of other businesses is not a form of Capital Expenditure. That’s part of M&A. It’s recorded separately in a different line item on the financial statements.

Growth CapEx

Growth CapEx refers to capital expenditures made by a company to expand or grow its business. These investments are typically focused on increasing revenue, improving market share, or entering new markets. Here’s a real example of Growth CapEx made by Apple.

One of Apple’s recent Growth CapEx initiatives is the development of its own processors for use in its Mac computers. In 2020, Apple announced that it would transition from using Intel processors to its own Apple Silicon processors. The company claimed this would provide better performance and energy efficiency. This initiative required significant investment in R&D equipment, as well as changes to Apple’s supply chain and manufacturing processes.

Apple has also invested heavily in building new retail stores, which have become a significant source of revenue. The spending required to buy the furniture and fixtures required to fill the retail stores is part of Growth CapEx. In recent years, Apple has opened new retail locations in China, India, and other emerging markets. These investments in retail stores have helped Apple to grow its customer base and increase sales of its products.

Maintenance CapEx

Maintenance CapEx refers to capital expenditures made by a company to maintain, repair or replace existing assets. Companies make these spendings to ensure their businesses continue to operate and prevent downtime or failure. These investments are typically focused on maintaining the existing level of operations and are necessary for a company’s long-term success. Here’s a real example of Maintenance CapEx made by United Airlines.

United Airlines is a well-known example of a company that invested heavily in Maintenance CapEx. In 2020, United Airlines announced that it would invest $1 billion in its facilities over the next few years to upgrade and modernize its aircraft fleet.

One of the key initiatives that United Airlines is undertaking as part of this investment is the construction of a new widebody aircraft maintenance facility at its hub in San Francisco. The new facility will be capable of performing maintenance on up to six widebody aircraft at a time. Additionally, it will include state-of-the-art equipment and technology to improve efficiency and reduce downtime.

United Airlines is also investing in the maintenance of its existing aircraft fleet, which is critical to the airline’s operations. In 2020, United Airlines invested $300 million in engine maintenance and overhauls.

Overall, Maintenance CapEx is an essential component of a company’s strategy to maintain its assets and ensure their continued operation. Companies that invest wisely in Maintenance CapEx initiatives can minimize downtime and prevent unexpected failures. Without Maintenance CapEx, equipment’s natural wear and tear can have significant impact on a company’s operations and profitability.

Capital Expenditures vs. Operating Expenses

Capital Expenditures (CapEx) and Operating Expenses (OpEx) are two types of spendings that a company incurs in its day-to-day operations. The main difference between the two is in the nature and timing of the expenses.

Capital Expenditures are investments in long-term assets that are expected to deliver multi-year benefits into the future. Examples include purchasing property or equipment, developing new technologies, or expanding a production facility. Because CapEx delivers multi-year benefits, companies amortize it over the useful life of the asset.

On the other hand, Operating Expenses are the costs incurred by a company to maintain its daily operations. These spending typically provide benefit that last less than a year. For example, common OpEx include rent, salaries, marketing, utilities, and other day-to-day expenses.

Another key difference between CapEx and OpEx is how companies treat them for accounting and tax purposes. CapEx is a capital asset that appears on a company’s Cash Flow Statement and Balance Sheet. OpEx is a cost that appears on a company’s Income Statement. CapEx creates Depreciation or Amortization over its useful life. By contrast, OpEx is fully deductible in the reporting period for tax purposes.

Is Capital Expenditures Tax Deductible?

Yes, CapEx is tax-deductible. While CapEx is typically not fully deductible in the year companies make the spending, it is generally tax-deductible over the useful life of the asset.

For tax purposes, CapEx is typically treated as a capital asset. This means it’s subject to Depreciation or Amortization over its useful life, as determined by the tax code. The IRS established rules for how to calculate the useful life of various types of assets. Companies must use these rules to determine the amount of Depreciation or Amortization to deduct each year.

Therefore, the tax deductions in the form of Depreciation & Amortization for CapEx are spread out over several years. This can help to reduce the company’s taxable income in each of those years. Companies that made significant CapEx can offset Depreciation & Amortization against their taxable income.

However, tax treatment of CapEx can vary depending on the specific circumstances of the investment and each country’s tax code.

CapEx Formulas

Because CapEx is a number that companies report directly on the Cash Flow Statement, you don’t really need to calculate it. However, there are a few formulas related to CapEx you should know.

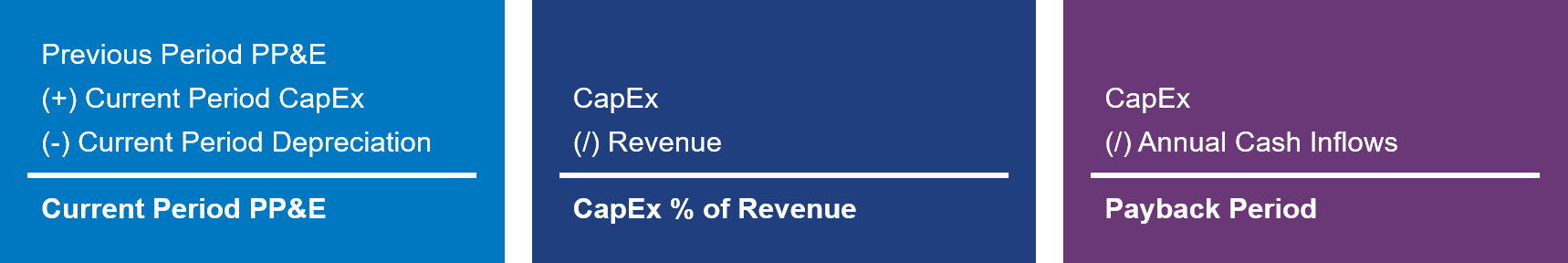

The first formula captures Capital Expenditures’ relationship with PP&E.

Previous Period PP&E + Current Period Capital Expenditures – Current Period Depreciation = Current Period PP&E.

This formula is used to calculate the total amount of capital expenditures made by a company during a specific period. It takes into account the ending and beginning balances of the company’s net property, plant, and equipment (PPE), as well as the depreciation expense incurred during the period.

The second formula captures Capital Expenditures’ relationship with Revenue.

Capital Expenditures / Revenue = CapEx as a % of Revenue

This formula calculates the percentage of sales that a company is investing in Capital Expenditures. It divides the company’s CapEx by its Revenue and measures the company’s capital intensity.

The third formula captures Capital Expenditures’ relationship with the expected benefits.

Capital Expenditures / Annual Incremental Cash Inflows = Payback Period

This formula calculates the time it takes for a company to recover CapEx through incremental cash flows from the CapEx. The shorter the payback period, the more economically attractive the investment.

How Do You Calculate CapEx?

Notice that none of the above formulas calculate CapEx per se. They all measure CapEx in relation to another metric, but none actually calculates CapEx itself.

That’s because CapEx is usually not a number companies calculate through a formula. It’s really based on however much they spend. For example, if they spent $50 buying an office desk, then CapEx is $50. If they spend $1,000 buying an office computer, then the CapEx is $1,000. A company’s total CapEx is the sum of all these investments in long-term assets.

Want to Learn More?

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.