What is Additional Paid-In Capital (APIC)?

Additional Paid-In Capital (APIC) represents the cumulative money investors paid in excess of stock’s Par Value in a primary market. We cover APIC in our Course 10, Lesson 24.

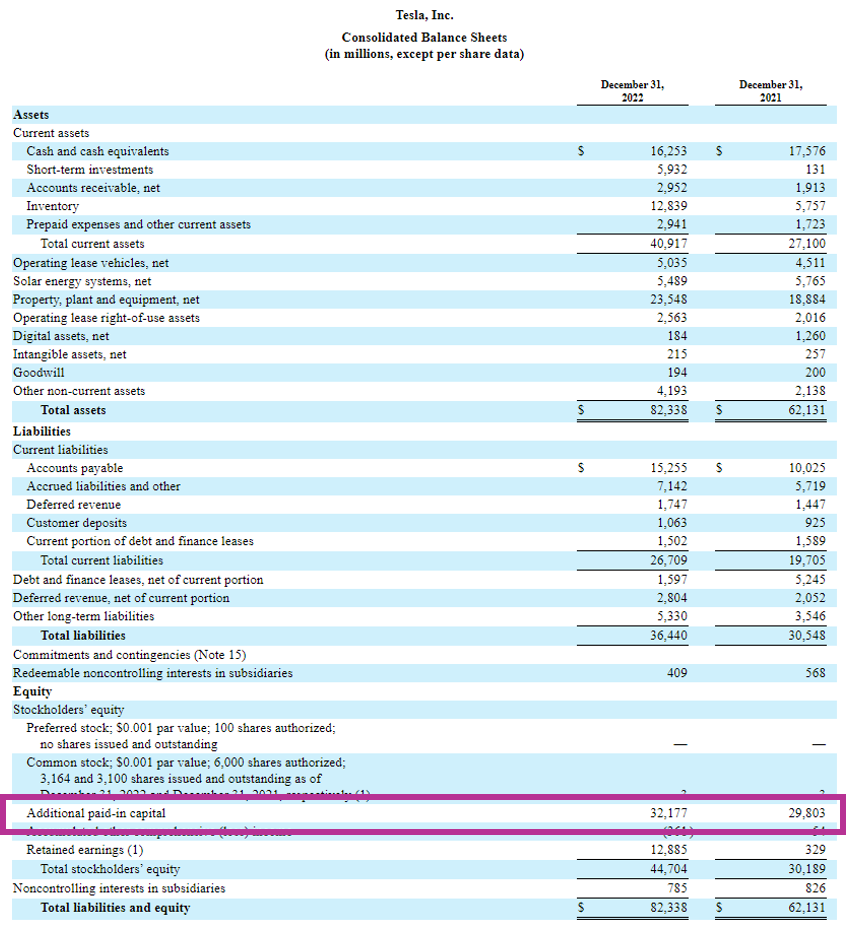

APIC is reported as a separate line item under the Shareholder’s Equity section of a company’s Balance Sheet. It typically appears alongside other equity line items, such as Retained Earnings and Common Stock Par Value.

APIC can have a significant impact on a company’s financial health and performance. Remember, APIC tracks money shareholders invested into the company. The company can use this cash to fund growth initiatives, such as Research & Development or Capital Expenditures. This, in turn, can help a company increase its market share, generate higher revenues, and improve profitability over time.

How APIC Gets Created

Notice the emphasis on primary market in the definition above. Buying in the primary market means that the investor is buying shares directly from the company. The investor’s money goes into the company’s bank account and the company’s shares goes into the investor’s brokerage account. By contrast, the buying and selling most of us see on the stock market are in the secondary market. Investors are buying from and selling to other investors. The cash does not go into the company’s bank account.

APIC is part of the Shareholder’s Equity section because it represents money that shareholders injected into the company. Emphasis on the word “injected”.

When us regular people buy stocks in the stock market, the money doesn’t go into the company’s bank account. We buy it from other shareholders so our money go to them and their shares come to us. But when investors buy shares directly from the company, they are effectively injecting money into the company.

APIC helps measure how much money investors injected into the company. In other words, when shareholders inject money into the company, it creates APIC.

Additional Paid-In Capital Formula

Here’s how to calculate Additional Paid-In Capital. In every transaction in the primary market, there’s an Offering Price (how much investors pay for each share), Par Value per Share (explained below), and Shares issued (the number of shares the company is selling to investors).

The product of Shares Issued and the difference between the Offering Price and the Par Value per Share equals APIC.

Par Value per Share

The Par Value of common stock is a small made-up number that companies can set discretionarily. It’s a made-up number. Basically, when you set up a corporation, you state will ask you to assign a paper value to each stock. You usually pick some small number, such as $0.01 or $0.00001 per share. For example, the Par Value of Tesla is $0.001. Why? Elon Musk probably liked it better than $0.01 or $0.000001. You can pick $0.0030313 if you want. It’s a made-up number. Well, you might ask, what’s the point then? You can think of this as a stale, ancient, out-of-date practice in today’s age but very inconvenient to change. As a result, the practice of assigning Par Value to each stock still exist today.

Market Price per Share

The Market Price of common stocks is the stock price we see in the stock market. If you open any apps or news and you see the stock price of a stock, that’s the Market Price.

When investors purchase shares of a company’s stock in the primary market, they pay the Offering Price for the shares. The Offering Price is usually slightly lower than the Market Price.

Additional Paid-In Capital Example

Let’s say Company A issues 1,000 shares of common stock. Offering Price is $5 per share and Par Value is $1 per share.

This means investors injected $5,000 cash into Company A ($5 per share x 1,000 shares). The total par value of the stock is $1,000 (1,000 Shares x $1 Par Value per Share). Therefore, the amount of money investors paid in excess of par value is $4,000 ($5,000 – $1,000).

To record this transaction on the Balance Sheet, Company A would record $1,000 of Common Stock Par Value and $4,000 of Additional Paid-In Capital.

Over time, as Company A continues to issue and sell shares of common stock, APIC would increase. APIC can also be affected by other transactions, such as the issuance of preferred stock or the exercise of stock options.

Tesla Additional Paid-In Capital

Let’s take a look at Tesla’s Additional Paid-In Capital. Here’s Tesla’s 2022 10-K. You can see that it has $3 million Par Value and $32,177 million Additional Paid-In Capital. Therefore, we can calculate investors invested a total of $32,180 million into Tesla.

Difference Between “Additional Paid-In Capital” and “Paid-In Capital”

Long story short, Paid-In Capital = Additional Paid-In Capital + Par Value.

Paid-In Capital (PIC) refers to the total amount of money shareholders invested into a company in a primary market. It includes both the par value of the stock and any additional funds paid above the par value. Balance Sheets usually don’t have a line for PIC. They usually only report Par Value and APIC. However, you can simply calculate this number by adding Par Value and APIC.

On the other hand, Additional Paid-In Capital (APIC) is a subset of PIC. Recall that APIC represents the cumulative money investors paid in excess of stock’s Par Value in a primary market.

Naturally, the sum of Additional Paid-In Capital and Par Value equals Paid-In Capital.

Impact of Stock Price Movements on APIC

Remember that APIC gets created from stock issuances in the primary market? It gets created when investors buy shares directly from the company, thereby putting cash directly into the company. Thereafter, as the stock trades publicly on the stock market, it has nothing to do with APIC. Therefore, stock price movements do not affect APIC.

However, because Offer Price in stock issuances is usually slightly below Market Price, as stock prices change, it will affect the Offer Price at which future shares are issued, and this can affect future APIC.

Learn More About APIC

At Lumovest, we’re building the place where anyone can learn finance and investing in an affordable and easy-to-understand manner. Our courses are far more intuitive, visualized, logical and colloquial than your college professor-taught courses. Our courses are taught by Goldman Sachs investment banker who has worked on transactions worth over $50 billion. We designed our courses to prepare you to succeed in the world of high finance. You’ll learn how to conduct financial analysis exactly like how it’s done on Wall Street’s top firms. Upon completion of the courses, you will receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.

In the video, it talked that Starbucks’s shareholder put 42.4 million in total into the company. What does this mean? Does this 42.4 means the original investment amount by earlier investor? I assume total investor paid more than 42.4 million to own a piece of company.

The $42.4 million in this case means that investors put a total of $42.4 million into Starbucks, on a net basis. In Starbucks case, they include Treasury Stock in APIC, so they net out cash given back to shareholders through share repurchases from the total cash that shareholders put into the company.

Usually, companies include Treasury Stock separately as an independent line item and so APIC + Common Stock measures how much money the original investors put into the company.

Can you please explain what Starbucks means under the common stock line item when it says “authorized, 2,400 shares; issued and outstanding, 1309.1 and 1,431.6, respectively”?

Thanks

Hi Jake,

Great question! Explanation below:

Authorized Shares = Number of shares the company is authorized to issue. When a company registers with the government to become a legal entity, it has to file “Articles of Incorporation”. In that document, it’ll specify that the maximum number of shares the company is authorized to issue. It can’t issue more shares beyond what’s authorized in the “Articles of Incorporation”. Any changes will need approval of the Board of Directors or via shareholder vote. Think of this number as just a number on paper that limits the maximum number of shares the company can have.

Issued Shares = Number of shares that have been “activated”. When shares are authorized, they’re just numbers on paper. But when they’re issued, they’re activated or “created” and sold to investors. Not all of these issued shares will be held by investors. Some of these issued shares will be repurchased by the company and be held in treasury.

Outstanding Shares = Number of shares that have been issued and currently held by shareholders. So whereas Issued Shares include both shares held by investors and shares held by the company treasury (repurchased), Outstanding Shares are shares held by investors. Hence, you calculate dilution and ownership off of Outstanding Shares.

Hope this explanation helps!

Thanks that explanation helps a lot