Background of Investment Banking in India

Banking services have long existed in India since the ancient times. By 1990, there were several thousand bankers in India.

In 1990, the country set up its own self-regulatory organization called the Association of Merchant Bankers of India (AMBI). In the early 2000s, the global investment banks expanded their operations into India. Recognizing the vast market potential of India, Goldman Sachs, Morgan Stanley, and others quickly built up their presence in the country. Subsequently, in 2010, AMBI changed its name to Association of Investment Bankers of India (AIBI). AIBI serves as the industry governing and self-regulatory body of the investment banking industry in India. All major investment banks are members of the AIBI.

Today, India is a high growth country with a vibrant financial market. All leading global investment banks have a regional presence in India. In addition, the country has successfully nurtured several of its own highly reputable domestic investment banks.

List of Investment Banks in India

Broadly speaking, there are two types of investment banks in India. First, there are the global investment banks. These are usually American and European investment banks with a regional presence in India, covering the Indian market. Second, there are the domestic Indian investment banks. These are local native banks founded in India. The global investment banks have greater scale, greater resources, and greater brand recognition than the native Indian investment banks. That’s because these global banks have presence around the world. However, the native Indian investment banks often have strong local relationships. They can win new mandates through their local connections and local know-how. Here’s a list of the top investment banks in India.

Global Investment Banks

Bank of America

Bank of America is an American multinational universal bank and financial services holding company headquartered in Charlotte, North Carolina. BofA Securities India Ltd is the subsidiary entity providing investment banking services for the Indian market. BofA Securities provides capital raising solutions, M&A advisory, securities research, and sales and trading capabilities.

Website (India): https://www.bofa-india.com/aboutus.html

Website: https://business.bofa.com/

Barclays

Barclays plc is a British multinational universal bank, headquartered in London, England. Founded more than 300 years ago in 1690, the company is listed on the New York Stock Exchange and the London Stock Exchange.

Website: https://home.barclays/

Citigroup

Citigroup is an American multinational universal bank, headquartered in New York City, New York. The investment banking services is provided through Citi’s Institutional Clients Group. Besides its investment banking services, Citi also offers retail banking services in India.

Website: https://icg.citi.com/icghome/what-we-do/bcma

Credit Suisse

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Founded in 1856, Credit Suisse also has a major focus on wealth management for the super wealthy. Credit Suisse established its presence in India in 1997. Today, the firm has offices in Mumbai, Pune and Gurgaon, with vendor offices in Bangalore, Hyderabad and Kolkata. India is the second-largest footprint for Credit Suisse outside of Switzerland, which demonstrates the importance of the country.

Website: https://www.credit-suisse.com/

Credit Suisse Pune Office

Deutsche Bank

Deutsche Bank AG is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany. Founded in 1870, the company is dual-listed today on the Frankfurt Stock Exchange and the New York Stock Exchange. While DB doesn’t offer retail banking services in many other big countries, DB does offer it in India.

Website: https://www.db.com/

Goldman Sachs

Goldman Sachs is an American multinational investment bank and financial services company headquartered in New York City. It is arguably the most prestigious investment bank in the world. It offers services in investment management, securities, asset management, prime brokerage, and securities underwriting. Goldman Sachs opened its Bengaluru office in 2004, Mumbai office in 2006 and Hyderabad office in 2021.

Website: https://www.goldmansachs.com/

HSBC

HSBC, officially known as The Hongkong and Shanghai Banking Corporation Limited, is a British universal bank. It operates branches and offices throughout the Indo-Pacific region, and in other countries around the world.

Website: https://www.hsbc.com/

J.P. Morgan

JPMorgan Chase & Co. is an American multinational universal bank and financial services holding company headquartered in New York City. JPM entered into the India market in 1922. Today, it has offices across Bengaluru, Hyderabad, and Mumbai.

Website: https://www.jpmorgan.com/

Jefferies

Jefferies Group LLC is an American multinational independent investment bank and financial services company headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. It was founded in 1962.

Website: https://jefferies.com/

Morgan Stanley

Morgan Stanley is an American multinational investment bank and financial services company headquartered in New York City. MS has been operating in India for over 26 years, providing a variety of services to domestic and international clients. It has five offices in India: four in Mumbai and one in Bengaluru.

Website: https://www.morganstanley.com/

Nomura

Nomura is a Japanese multinational universal bank with an integrated network spanning over 30 countries. Founded in 1925, it employs nearly 30,000 customers across the world. Nomura set up its Indian operations in Mumbai in 2005. Today, Nomura India employs staff across Investment Banking, Global Markets, and Corporate Infrastructure divisions.

Website: https://www.nomura.com/

UBS Investment Bank

UBS is a Swiss multinational investment bank founded and based in Switzerland. Co-headquartered in Zürich and Basel, UBS operates in all major financial centers around the world. UBS Securities India Private Limited is the company’s subsidiary entity providing investment banking services in India.

Website: https://www.ubs.com/

Indian Investment Banks

Many domestic Indian investment banks have very good deal flow in India. The following firms have the most deal flow according to data compiled on Indian M&A and financing transactions.

- AK Capital Services

- Avendus Capital

- Axis Bank

- Bajaj Capital

- Derivium Capital

- Edelweiss Financial Services Ltd

- HDFC Bank

- ICICI Bank

- ICICI Securities Primary Dealership Limited:

- Indusind Bank Ltd

- JM Financial Ltd

- Karvey Consultants Ltd

- Kotak Mahindra Bank Ltd

- LKP Securities

- L&T Financial Services

- Punjab National Bank (India)

- RBSA Advisors

- Real Growth Securities Pvt Ltd

- SPA Capital Advisors Ltd

- State Bank of India (SBI)

- Tipsons Consultancy Services

- Trust Group

- Yes Bank

Services for the Indian Market

In the preceding section, we talked about the two types of investment banks in India. The global investment banks with a regional office in India and the domestic Indian banks specializing in India. There’s a pretty clear divergence in the type of services the two types of investment banks offer.

The global investment banks focus on (i) Mergers & Acquisitions (M&A) and (ii) Capital Markets (Financing). M&A refers to the buying and selling of companies. Capital Markets refers to raising capital from debt and equity investors. M&A and financing are the heart and soul of the global investment banks. These firms generate most of their investment banking revenue from M&A advisory fees and underwriting fees.

By contrast, the domestic Indian investment banks offer a wide range of investment banking services. Similar to the global banks, the domestic Indian investment banks also provide M&A and financing advisory services. However, in addition to these two core services, the native firms also offer a wide range of ancillary services.

Start-Up Advisory

Domestic banks can advise start-ups through early stage fundraising. Similarly, they can also help venture capital firms with finding attractive investment opportunities.

Partner Search / Joint Venture

As multinational corporations do in many places in Asia, they often form joint venture partnerships with local domestic companies. The domestic banks can advise them through this process and helping them find the right local partner.

Restructuring

After India passed the Insolvency and Bankruptcy Code, 2016 (IBC 2016), the country possesses a legal framework for restructuring and reorganization. The local domestic banks provide this service to work with creditors and debtors through the IBC 2016.

Due Diligence

Domestic banks can also conduct due diligence for their clients. This is not something that the global investment banks offer as a standalone service. The global banks will usually conduct due diligence as part of M&A or financing advisory. However, the domestic banks differentiate themselves by offering this service to clients in silo.

Investment Banking in India Salaries

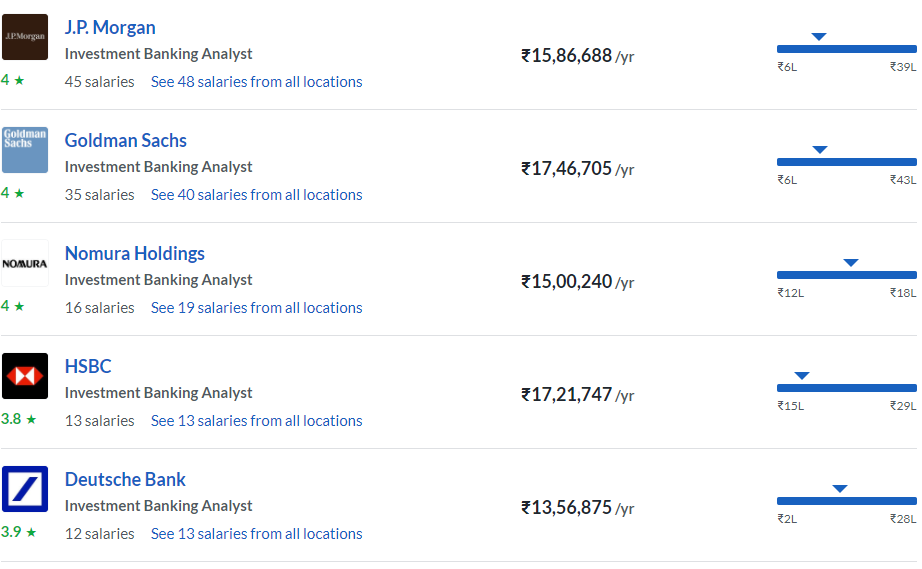

Here are some of the salary information for an entry-level investment banking analyst position at the global investment banks. Please note that this is just the salary. Investment banking compensation includes a mixture of (i) salary, (ii) bonus, and on some rare occasions (iii) stock-based compensation. Therefore, total all-in compensation is likely higher than the figures below.

GFIA Certification for Investment Banking in India

Because investment banking is a very high paying job, it’s very competitive. To successfully break into the industry, candidates should demonstrate (i) a track record of excellence and (ii) mastery of financial analysis.

You can demonstrate a track record of excellence through academics, extracurriculars and work experience. Academically, you can demonstrate this by attending some of the top universities such as University of Delhi and IIT. In addition, grades and test scores also matter. Extracurricular-wise, if you’ve won certain competitions in your hobbies, that would also add points. And work experience wise, you can strengthen your candidacy by working at big companies and through investment banking internships.

You can demonstrate mastery of financial analysis through our GFIA Certification program. We offer a full suite of financial analysis courses to prepare you for a career in investment banking. Upon successful completion of our program, you’ll receive our Global Financial & Investment Analyst (GFIA) certification. You can sign up here.