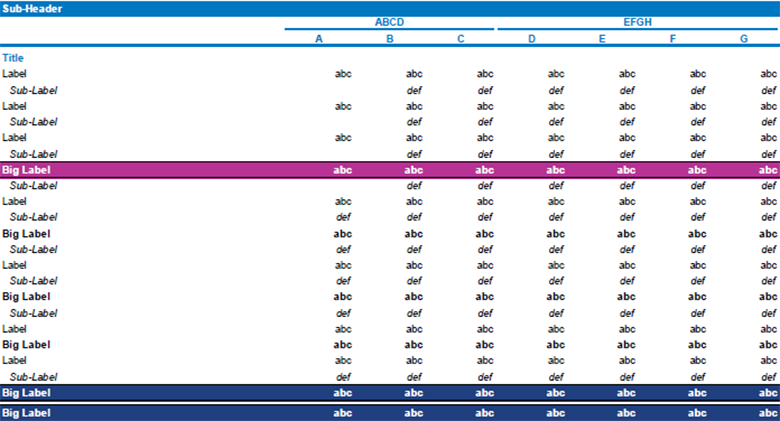

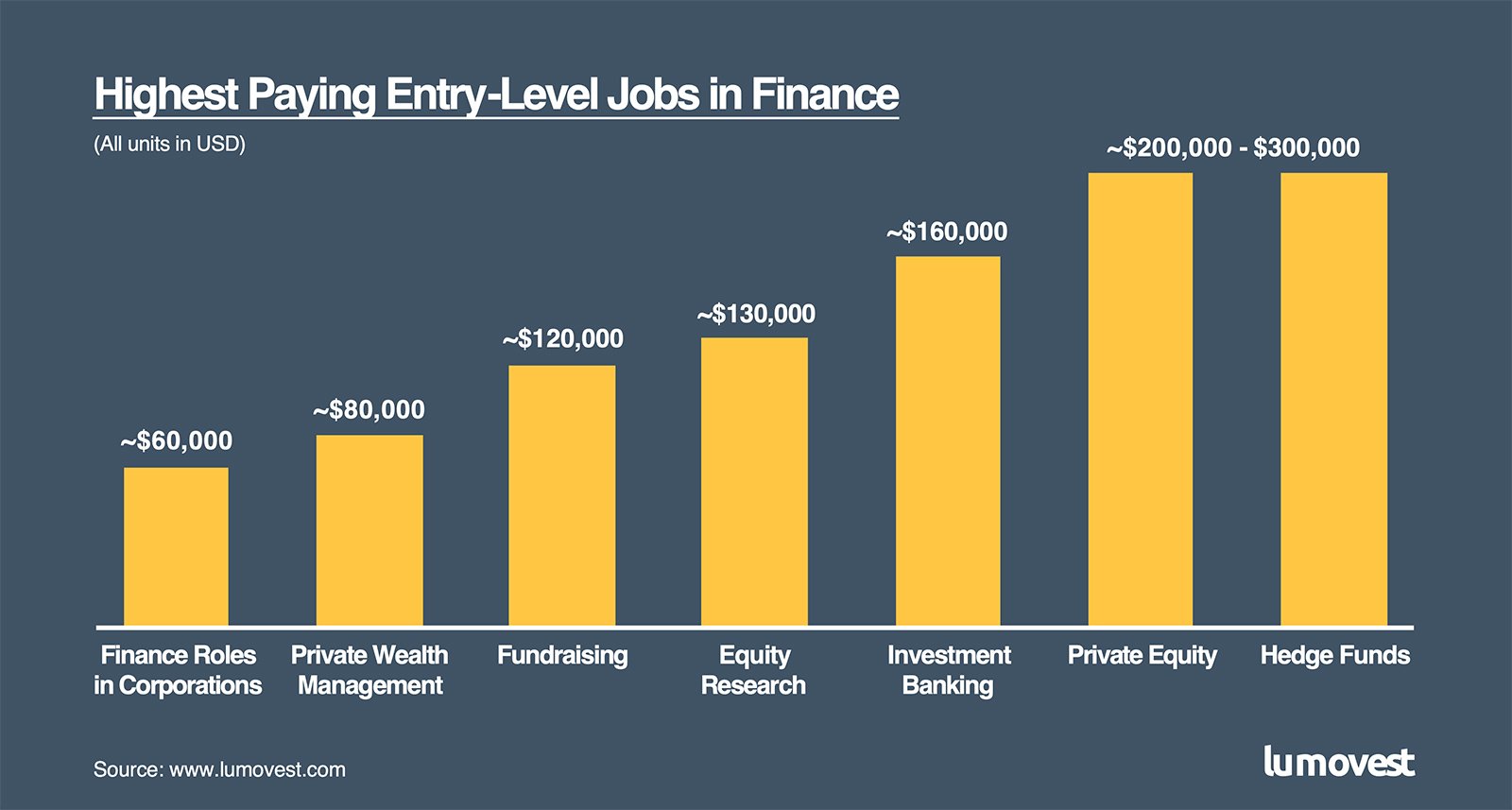

The highest paying finance jobs can be very lucrative, but the truth is that not all finance jobs are created equal. Some inherently pay more than others.

Through this article, we’ll explain 7 different fields within finance that do completely different things. We’ll go over what you do in each field, the skills you need to succeed and the earnings potentials. All earnings numbers in the section headers are for entry-level opportunities. You can make a lot more as you gain experience and rise up the ranks, which we discuss below for some of the more structured fields within finance.

Without further ado, let’s jump in and learn about the highest paying finance jobs!

I. Investment Banking (IB): ~$160,000+ Starting Pay

Investment banking is one of the highest paying finance jobs. They recruit directly out of college, where a 21-22 year old graduate can earn ~$160,000 in the first year. So what do investment bankers do?

Investment bankers really just do 2 things.

First, they help companies buy other companies or sell themselves to other companies:

For example, when Amazon bought Whole Foods in 2017, the investment bankers at Goldman Sachs advised Amazon on the purchase and the investment bankers at Evercore advised Whole Foods on the sale. This is known as mergers & acquisition (“M&A”). The process for a company to buy another business or to sell itself is very complicated and companies need to hire investment bankers to advise them through the process. Investment bankers help them structure the transaction, negotiate terms, determine the valuation (the price tag), etc. You can think of them like real estate brokers in this sense, except instead of brokering real estate between buyers and sellers, they’re brokering companies.

Second, they help companies raise money:

Large companies often need more money to fund their expansion than they have available in their bank account. Take Tesla for example. Despite being a public company, Tesla burns a lot of cash and need more money than they have in the bank to fund their expansion plans. So they need to raise money. But where are they going to get the money from? That’s where the investment bankers come into play. The investment bankers help companies raise the money they need from investors.

Because the large investment banks help big companies deal with transactions that are often in the billions of dollars, a meager transaction fee of just 0.5% of the transaction value could be worth tens of millions of dollars. Naturally, because the investment banks earn ridiculous amount of fees for the work they do, they also pay their investment bankers ridiculous amounts of money. It’s one of the most lucrative careers anyone can have in finance.

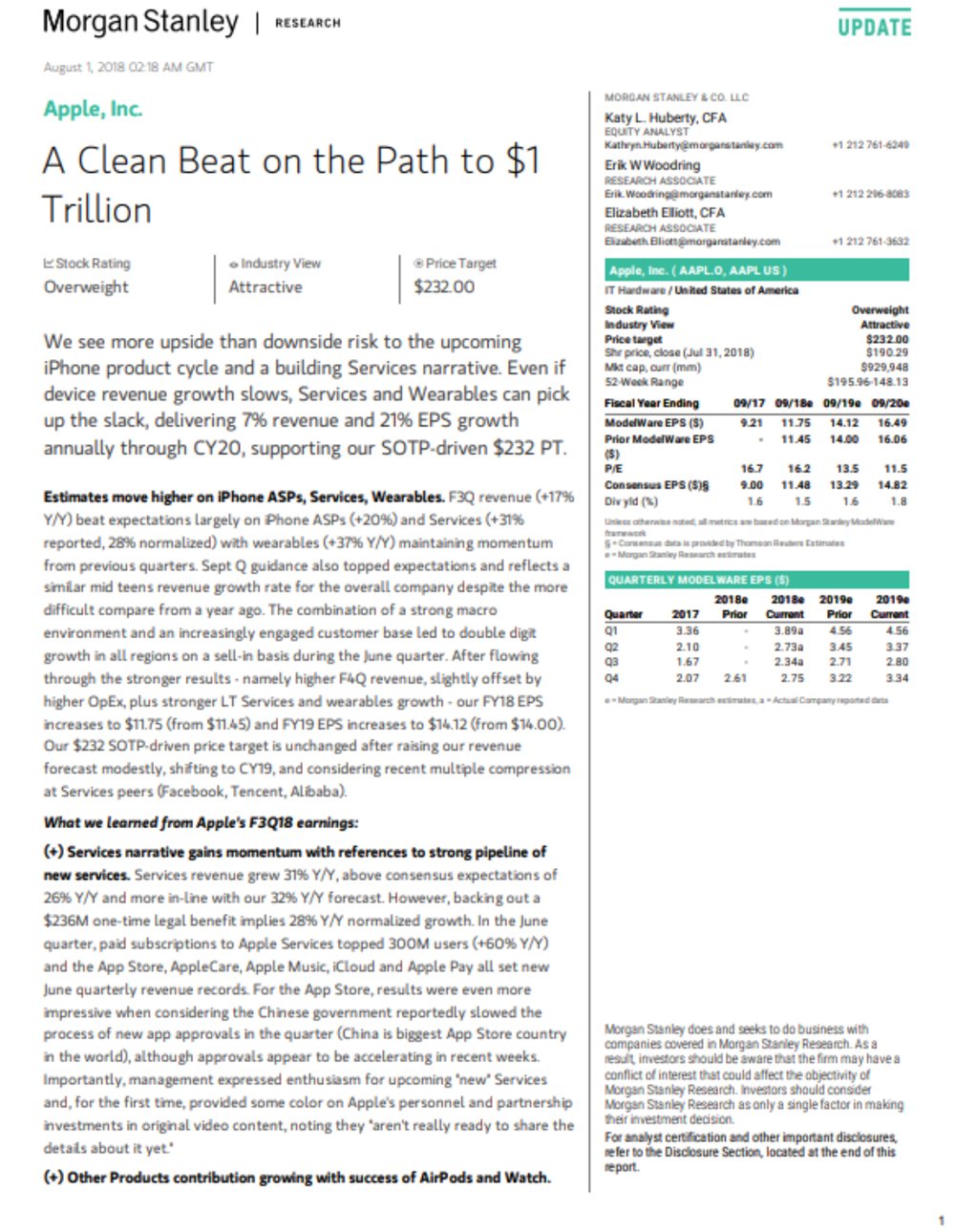

Here’s what you can expect to make at each level, assuming you are at one of the leading investment banks (i.e. Goldman Sachs, Morgan Stanley, J.P. Morgan):

Analyst: ~$160,000 / year

Investment Banking Analysts are usually 21-24 years old with a Bachelor’s degree from a top university. Banks hire analysts straight out of undergraduate programs. Their primary responsibilities are to analyze and value companies (which we teach in our Lumovest courses). The compensation is usually structured in the form of a signing bonus + base salary + year-end bonus. Top analysts work for 2-3 years and then get promoted to Associate.

Associate: ~$250,000 / year

Investment Banking Associates are usually 25-30 years old. They’re either promoted from Analysts or MBAs hired from business schools. Associates are responsible for managing Analysts and checking Analysts’ work. For this reason, Associates also need to have a solid technical foundation. Top performing Associates usually work for 3-4 years and then get promoted to Vice President.

Vice President: ~$400,000 / year

Investment Banking Vice Presidents are almost always those who have prior investment banking Analyst or Associate experiences. They’re usually 28-35 years old. They are responsible for overseeing the work streams, thinking through what work is needed to be done and making sure they’re done correctly and on time by the Analysts and Associates.

Managing Director: ~$1,000,000+ / year

Investment Banking Managing Directors are responsible for the entire deal process. They’re not only responsible for bringing in the business in the first place, but also responsible for delivering the advisory service in a high-quality manner to the clients. A Partner Managing Director at Goldman Sachs, for example, earns $950,000 in base salary alone. With performance bonus, Goldman Sachs Partner Managing Directors can bring home several million dollars in a single year, which makes it one of the highest paying jobs in finance. At this point of your career, the pay is highly dependent on how good you are with clients and the amount of business you bring in. If you bring in hundreds of millions of dollars in fees a year, you can get paid tens of millions.

Not everyone who work in an investment bank will earn this much. Only the actual investment bankers within the investment banks will earn this level of pay. Other employees such as administrators and support-staff will earn a lot less.

II. Private Equity (PE): ~$200-300K+

Private equity is arguably one of the highest paying finance jobs that anyone can have. The starting salary for a private equity professional (known as “Associates”) is often $200,000 to $300,000 for a 23-25 year old!

Every year, only a few hundred people in the entire world will get accepted into the top private equity firms. But once you’re in, you stand to make a ton of money. So what exactly do private equity firms do?

Private equity firms are investors. They invest in companies. It’s very similar to what you’re doing when you buy stocks on the stock market. Except instead of just buying a piece of the company through stocks, they’re buying the entire company. That’s right. They buy the entire company, which often cost billions of dollars. They make money when their investments go well.

Most of the large-cap private equity firms use an investment strategy known as leveraged buyouts (“LBO”). They’re using leverage (finance jargon for debt) to buy out the original owners of the company. Hence the name, leveraged buyouts. We explain this investment strategy in greater detail here.

Associate: ~$200,000 – $300,000 / year

Private Equity Associates are usually 23-25 years old who completed an Investment Banking Analyst program at a top investment bank. They’re often hired from the world’s leading investment banks, such as Goldman Sachs, Morgan Stanley, J.P. Morgan, etc. Their primary responsibilities are to analyze and evaluate investment opportunities (which we teach in our Lumovest courses). Most of their time is spent in the office using Microsoft Excel, Word and PowerPoint. The Associate program is usually 2-3 years, where top performers can be promoted to Senior Associates / Vice Presidents.

Senior Associate / Vice President: ~$500,000 / year

Private Equity Senior Associates are usually in their late 20s who were directly promoted from Associate or who are MBAs hired out of business school. Those who are hired out of business school usually have pre-MBA private equity associate work experience. It’s extremely difficult to land a job as a Senior Associate or Vice President without prior PE experience.

Principal / Directors: ~$700,000 / year

Starting from here, the compensation varies a lot based on individual performance, but $700,000 per year is common at this level. It’s a mix of salary and year-end bonus. It doesn’t even include the carried interest that you’ll get when the private equity funds are harvested. Depending on your carried interest allocation and the investment performance, you can potentially make an additional several million dollars!

Managing Director / Partner: $1-100 million / year

At this level, the sky is the limit. You’re running the show and playing a leading role in investments and managing your team. You’ll likely earn +$1 million in salary and bonus, but the majority of the compensation will come in the form of carried interest. The top guys in this industry are billionaires and earn hundreds of millions of dollars a year.

III. Hedge Fund (HF): ~$200-300K+

An investment role at a hedge fund is one of the highest paying finance jobs you can have. You can earn even more than the private equity investment professionals in a single year. That’s because 1) hedge funds have less expenses than private equity firms and 2) hedge funds receive their performance fees (HF equivalent to PE’s carried interest) sooner than private equity firms. Top performing hedge fund managers take home tens of millions to billions of dollars in a single year. In fact, many of those on the Forbes billionaires list are hedge fund managers: Ray Dalio, Ken Griffin, Steven Cohen, Bill Ackman, David Einhorn, Larry Robbins, etc. The list goes on.

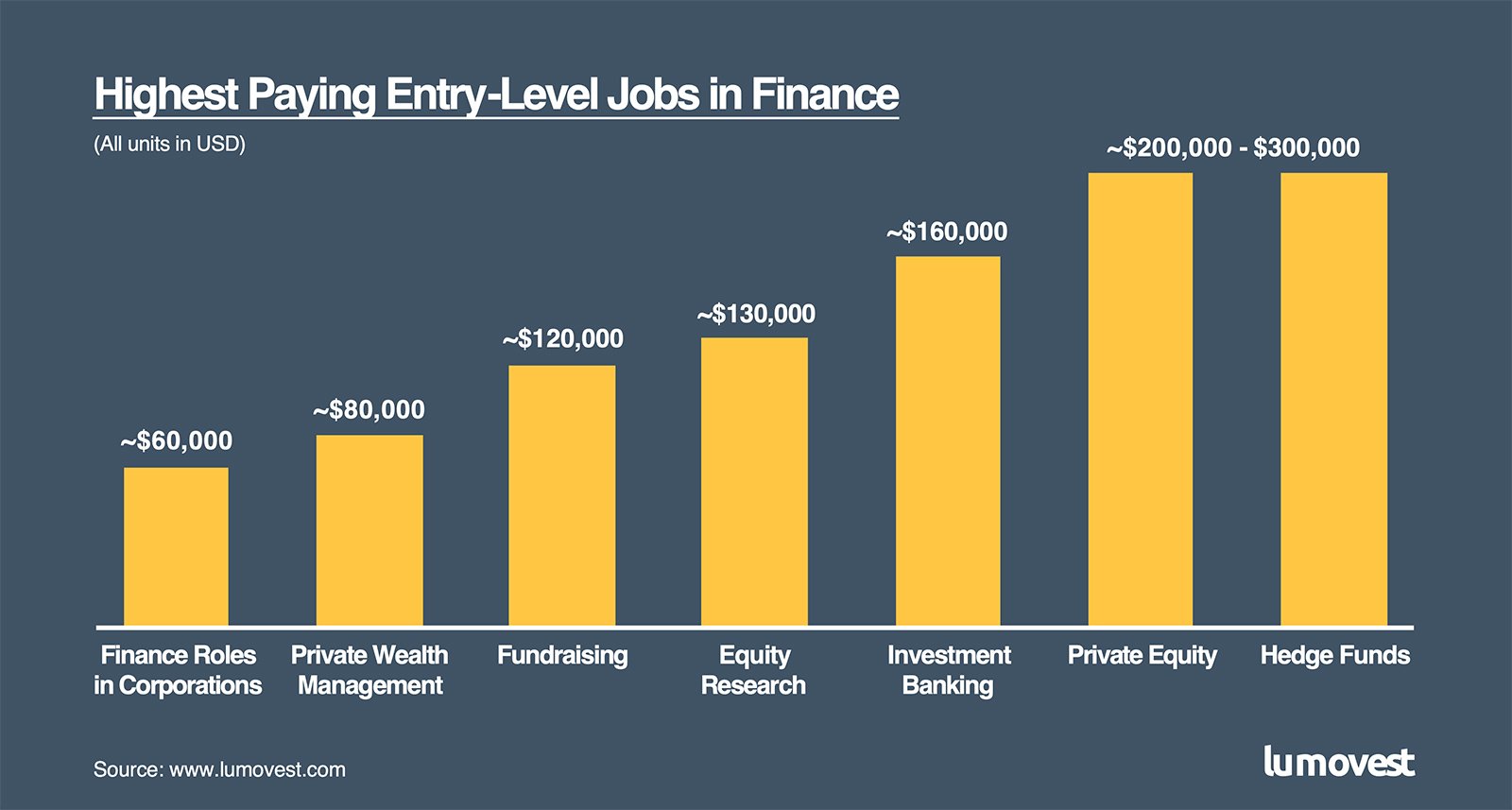

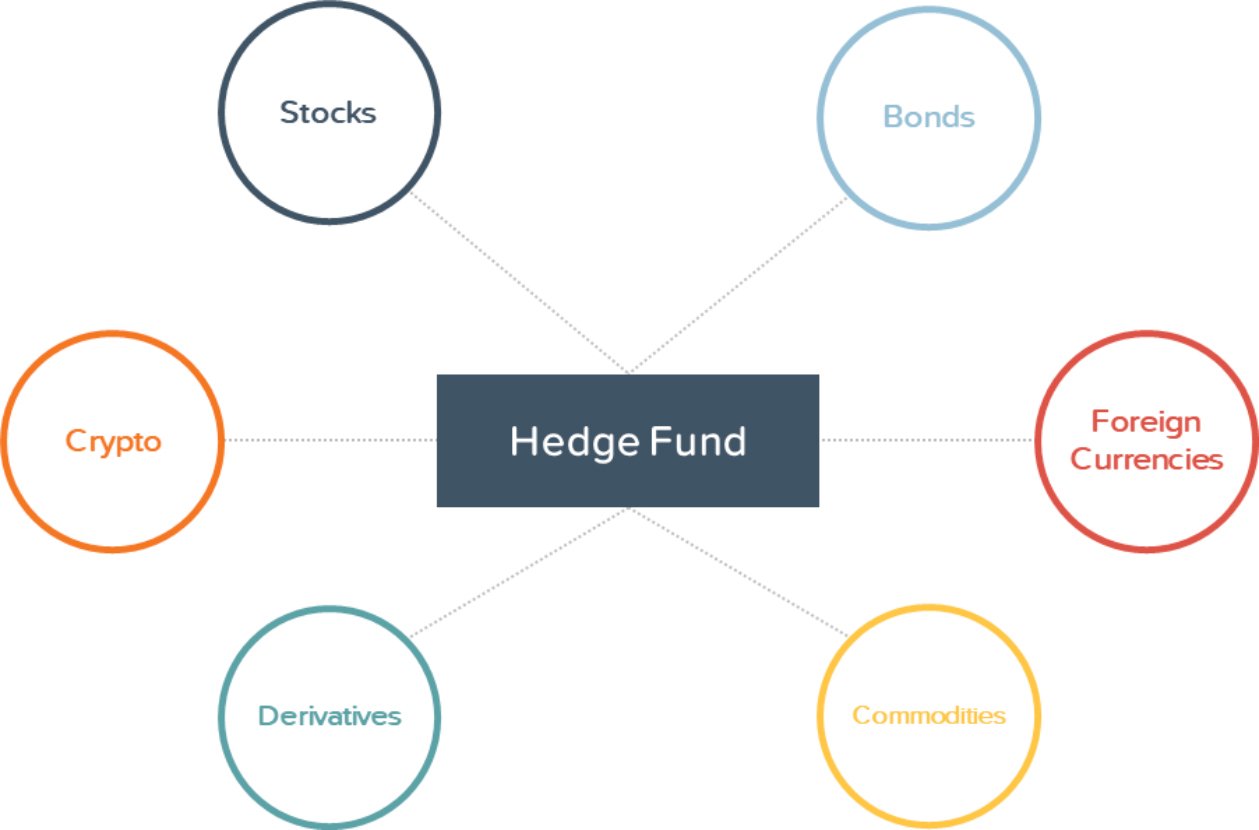

So what do these hedge fund managers do?

In simple terms, hedge funds are investors. They invest in publicly-traded securities or things that are traded on the market and available for purchase to anyone in the general public. Equity hedge funds invest in stocks. Credit hedge funds invest in debt. And other hedge funds invest in things like commodities or currencies. Regardless, they usually invest in things that they can easily buy and sell on the market.

If you’re an investment professional at a hedge fund, you basically research investment opportunities for whatever it is that your hedge fund focuses on. So if you work at an equity hedge fund your job is to invest in stocks. It’s just like buying stocks for your own personal portfolio, except you do it with billions of dollars and you get paid a lofty salary to do it.

Here’s how much you can expect to make at a large $1bn+ hedge fund:

Research / Investment Analyst: ~$200,000 – $700,000 / year

Research / Investment Analysts at the sizable hedge funds that pay this much are usually people in their 20s and 30s who were former Investment Banking Analysts or Private Equity Associates. Your pay will be a mix of salary and bonus. You’re responsible for analyzing stocks and bonds, usually using the fundamental analysis approach, to identify attractive investment opportunities. Basically, you help the Portfolio Manager pick investment ideas.

Portfolio Manager: millions to billions / year

Once you’re a PM, your earnings will be largely dependent on your investment performance. Did you pick winning stock ideas? Your pay will be largely dependent on how much profit you made for the firm. In the stock market, the sky is the limit. There are hedge fund managers who take home billions of dollars in a single year.

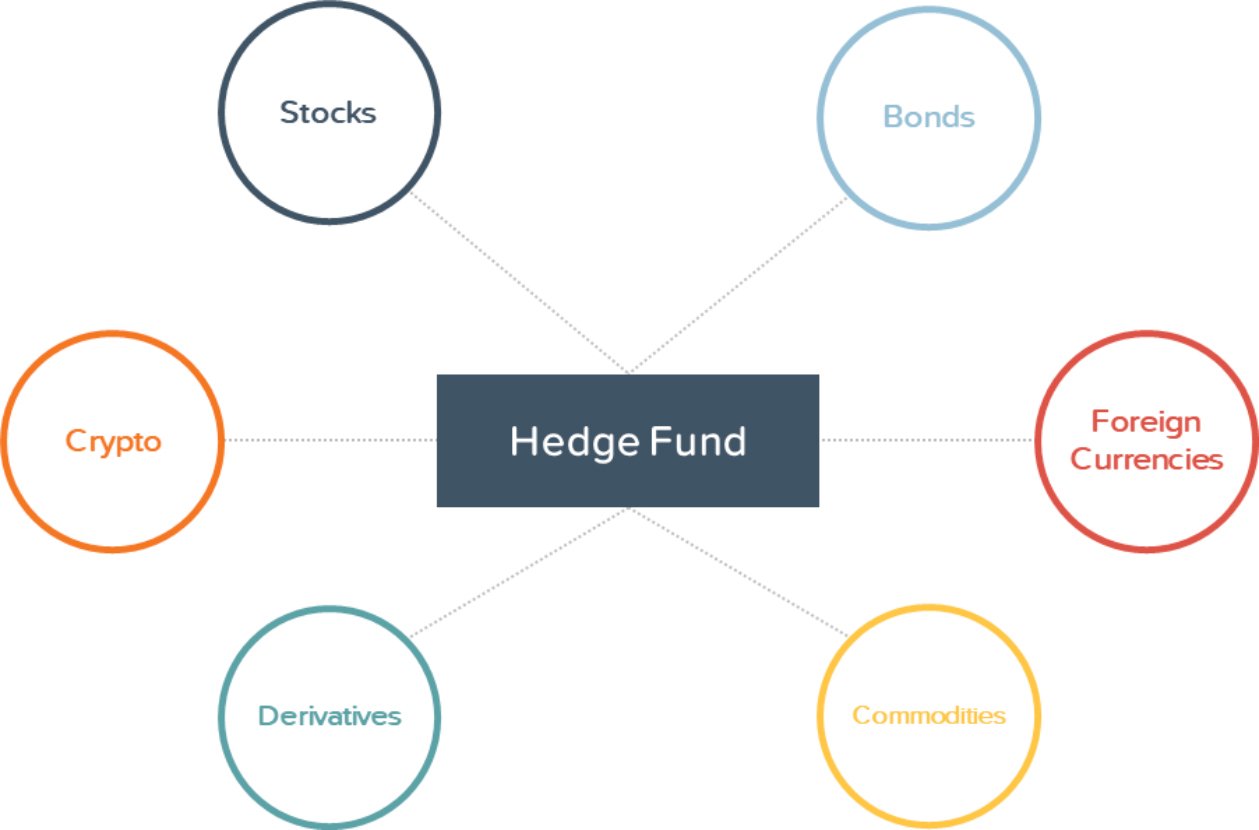

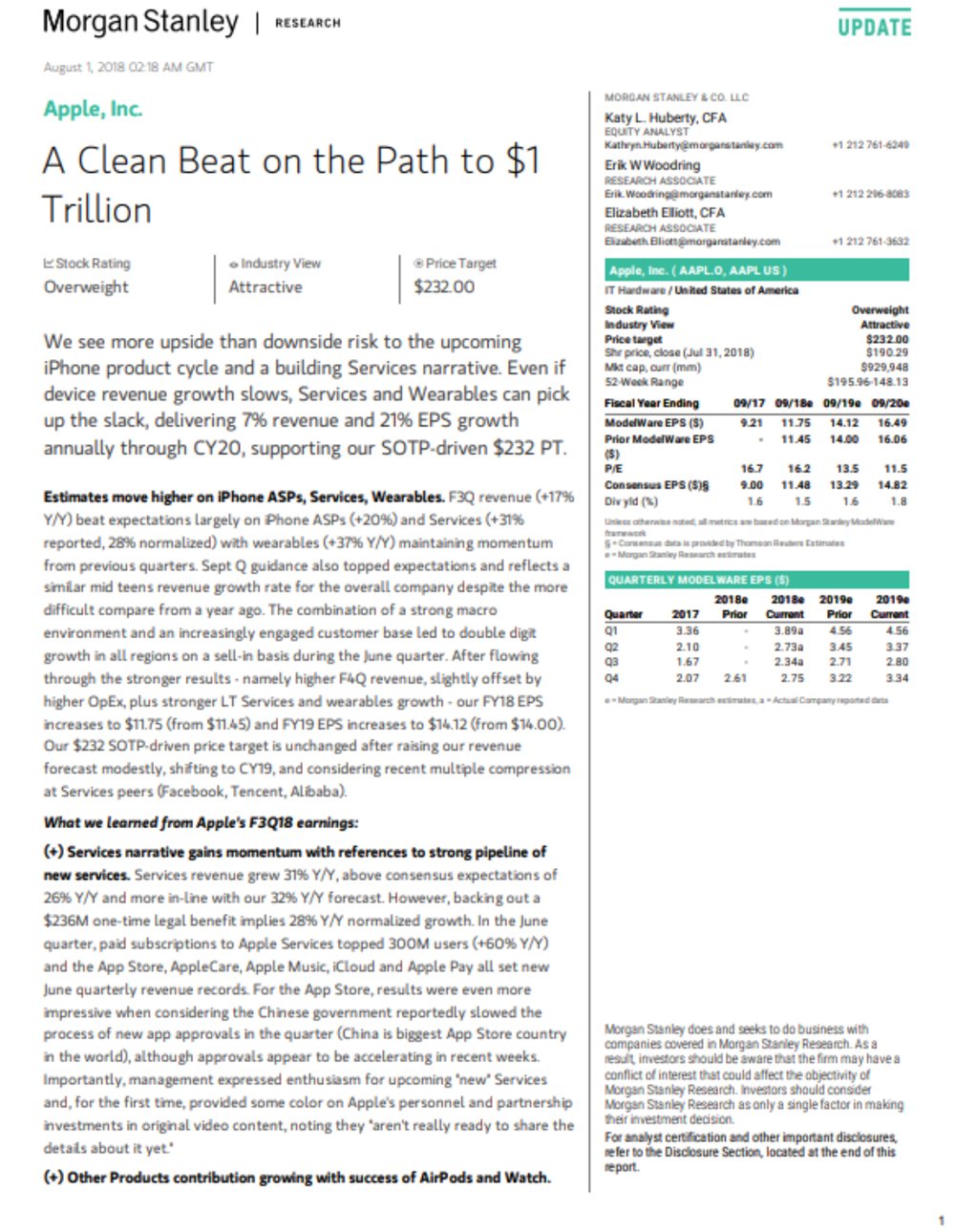

IV. Equity Research (ER): ~$130K+

The word “equity” is just a fancy word for “stock”, so taken together, equity research just means “stock research”. The job is exactly what it sounds like. You research stocks. Entry-level analysts make approximately $130,000 in their first year, which makes it one of the highest paying finance jobs for an entry-level role. But wait a minute. Doesn’t this sound awfully a lot like the work you do at a hedge fund that invest in stocks?

You mostly do the same things as the investment professionals at hedge funds: screening stocks, reading company reports, analyzing financials, talking to management teams and industry experts, etc. While the work is very similar, you’re doing it in a different capacity.

In equity research, you’re publishing your research into a report, which your firm sells to clients. You’re doing the work for your clients and educating them about different stocks. You’re in the business of selling your homework. For this reason, equity research is also known as “sell-side research”.

And unfortunately, selling your research reports to clients just isn’t as profitable of a business model as investment management. The business just doesn’t make as much money as one that manages and invests other people’s money. Hence, equity research analysts tend to make a lot less than hedge fund investment professionals because their companies make a lot less money than hedge funds. It has less to do with their own capability, and much more to do with how much profits their employers make.

The good thing about the equity research analyst program is that it’s often a feeder into hedge fund investment analyst roles. Equity research entry-level jobs will provide you with a fantastic learning experience and develop a strong foundation, on which you can launch a hedge fund career in investing.

V. Fundraising: ~$120K+

Fundraising is an extremely important function in investment management companies. In simple terms, investment management companies (i.e. hedge funds, private equity firms) manage other people’s money. The more money they manage, the more money they make. And fundraising is the process they go through to raise the money they manage. See the logic here? No fundraising, no money to manage, no investments, no business.

For this reason, fundraising plays an extremely important role in hedge funds and private equity firms. This is a job that requires a combination of sales skills and financial analytical skills. Entry-level fundraising analysts earn about ~$100,000 to 120,000 a year.

You’re kind of a salesperson in that you’re trying to sell your company’s services to prospective investors. You’re trying to convince them that your company is a brilliant investment institution that can earn them a lot more money. You need to convince them to hand over millions and millions of dollars for you to invest. This requires strong interpersonal relationship skills and ability to think through the big picture and tell great stories.

But you also need hardcore financial analytical skills because you’ll be conversing with investors about investment opportunities, about companies that your firm had invested in, investment performance, etc. Just like how insurance salespeople know their stuff about insurance, you’ll need to know your stuff about finance. For this reason, many of the leading hedge funds and private equity firms hire out of investment banking or private equity for their fundraising roles.

Now frankly, the pay isn’t as high as investment professionals at these firms. But it’s still very lucrative compared to other careers and it gets higher and higher as you get more senior.

VI. Wealth Management: ~$80K+

Private wealth management (“PWM”) basically provides wealth advisory services to high-net worth clients. Your clients are individual persons or families with lots of money. And you’re advising them on how to manage their wealth. Everything from where to put their money to retirement planning to estate planning and inheritance.

Due to the nature of this work, personal finance is more relevant for this job than corporate finance. Knowledge of corporate finance will come into play when you’re analyzing investment opportunities, but generally speaking, the work is more related to personal finance than corporate finance. For this reason, the job doesn’t involve as much heavy analytical work as jobs in investment banking or private equity or hedge funds. Interpersonal skills, the ability to connect with your clients is much more valuable in this field.

Entry-level private wealth management analysts at reputable firms can expect to make about ~$80,000 in a single year. As you become more senior and start to have more clients, the pay will really depend on how much money you manage and how many clients you have. If you manage the wealth for Bill Gates or Jeff Bezos, for example, you’ll obviously make a lot more money than if you were to manage wealth for a local millionaire. So as you rise up the ranks, the pay can vary significantly. Top wealth advisors can make millions in a single year.

VII. Finance Roles within Corporations: ~$60K+

By finance standards, entry-level finance roles within actual corporations is probably on the lower-end in terms of pay. These are jobs in Financial Planning & Analysis or Corporate Development. Entry level pay is around $60,000 according to Glassdoor.

Relative to what the investment bankers, private equity investors and hedge fund managers make, this is peanuts. But this pay is still very high relative to the average profession. The average US household income is about $60,000, so $60,000 per year for an entry-level finance job is still very high when looking at this in relation to the broader population.

Sure, the entry-level pay is on the lower end relative to other jobs in finance. However, as you move up the corporate ladder, that’s where things start to get interesting. Pay starts to catch up. In fact, top-ranking finance professionals within large corporations often make much more than Investment Banking or Private Equity Managing Directors. CFOs at large corporations can make several million to tens of millions of dollars in a single year. Potential seven to eight-figure pay packages make the CFO role one of the highest paying jobs in finance. But the key deciding factor here is the size of the corporation as opposed to your performance.

Large corporations will pay a lot more than small companies. So all else equal, you’ll make much more at a large publicly-traded corporation than you will at a small mom and pop company.

How to Get One of the Highest Paying Finance Jobs

So these are the highest paying jobs in finance. If you’re convinced you want a job in finance, you’ll need to work hard for it. For most people, these six-figure jobs won’t just magically drop on their laps. It’s a very competitive industry precisely because the pay is so high. So what can you do to maximize your chances of breaking in?

If you’re a student: You should try to attend a leading university and major in business / finance / accounting or something similar. You should seek out finance-related internships in your freshman and sophomore years and apply for the structured Summer Analyst programs at the large investment banks for the summer of your junior year. Academics (school + major + GPA) and prior internships are extremely important in the interview selection process, so make sure you build up that profile.

If you’re a working professional looking to make a career switch: You’ll need to do a lot of networking if you aren’t in the industry already. You also need to learn finance and accounting on your own to prove to the interviewers that you’re serious about the job. Another alternative would be to attend business school to earn a MBA degree. A MBA degree will enable you to make a career switch into the financial services industry.

Regardless of your background, you should check out our online education platform. We are a leading provider of financial education and have a structured curriculum designed to teach you the knowledge taught to employees at Wall Street’s most elite investment banks and investment firms. You can sign up here.

Thanks for reading this article. As always, if you have any questions, please don’t hesitate to email our support team!